Brooklyn’s tallest building — part of it, at least — is up for sale in what will be a major test for the city’s investment sales market.

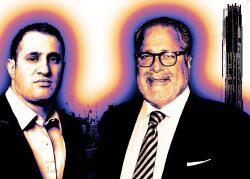

Michael Stern’s JDS Development has listed the rental and retail portion of the 93-story tower at 9 DeKalb Avenue and is eyeing between $600 million and $700 million, sources confirmed to The Real Deal.

The 398-unit rental part of the building will test buyers’ appetites for big-ticket assets at a time when high interest rates are complicating deals.

A representative for JDS Development did not immediately respond to a request for comment. Real Estate Alert first reported news of the listing, which is being handled by the Doug Harmon and Adam Spies team at Newmark.

Stern’s Brooklyn Tower is made up of the rental portion, plus a 130,000-square-foot retail section mostly occupied by the luxury gym chain Life Time Fitness and 143 residential condominiums. The condos are not part of the offering.

The 1,000-foot-tall building towers over Downtown Brooklyn and is the borough’s first supertall skyscraper.

Stern began developing the site at the former Dime Savings Bank in 2015, buying the property with partner Joseph Chetrit for $90 million. Stern bought out Chetrit’s stake in 2018, leading to a lawsuit last year after Chetrit claimed he was owed more money from the deal.

JDS launched sales of the condos in March of last year.

The rental portion benefits from a 35-year tax abatement and has 30 percent of its units set aside for income-restricted renters. The building is expected to get its temporary certificate of occupancy within the next 60 days.

In Manhattan, JDS and its partner Baupost Group last year sold the American Copper Buildings for $850 million to a joint venture between Josh Gotlib’s Black Spruce Management and Meyer Orbach’s Orbach Affordable Housing. It was one of the last major deals to close in the city before rising interest rates cooled the investment sales market.

Read more