For the cost of a pizza slice, Boston Properties significantly increased its stake in a Midtown South office property.

BXP acquired a 29 percent stake in 360 Park Avenue South for the basement price of $1, Crain’s reported. Essentially, the Canadian Pension Plan Investment Board was ready to wash its hands of the investment it made at the vacant building.

While the pension fund already poured $71 million into the property, its exit will save CPP from some future obligations. The pension plan is being released from $46 million in future funding, as well as $5 million in annual interest payments stemming from BXP’s assumption of CPP’s share of the $220 million mortgage.

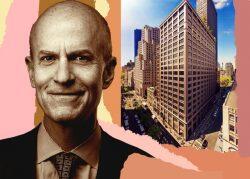

BXP bought the property in 2021 for $300 million, quickly launching an extensive $100 million renovation after the acquisition. The purchase, made in a joint venture with the Steinberg family’s Empire Asset Management, gave BXP a 42 percent stake, as well as leasing and management responsibility for the 20-story, 440,000-square-foot property.

BXP chief executive officer Owen Thomas said CPP’s decision was indicative “of a change in strategy.”

In October, San Francisco-based wealth manager Iconiq Capital signed a deal for 70,000 square feet, becoming the first tenant to sign on under the new ownership. The building is 18 percent leased and tenants are expected to start moving in over the summer.

This isn’t the first time in recent weeks an investor has walked away from a Manhattan property without much to immediately show for it. SL Green recently acquired a 95 percent stake in the leasehold at 2 Herald Square for next to nothing, only paying $7 million to settle the property’s $182 million mortgage.

CPP’s decision could foretell a reduction in real estate exposure for the pension plan, according to BMO Capital Markets analyst John Kim. The pension fund, which manages more than $400 billion in assets, owns a 49 percent stake in SL Green’s 10 East 53rd Street.

In 2022, real estate investments from pension funds and large institutions fell 60 percent to $22 billion, according to Preqin.

— Holden Walter-Warner

Read more