Z&L Properties, a firm linked to a San Francisco corruption scandal, is poised to default on unsold condos in a twin-tower complex in Downtown San Jose.

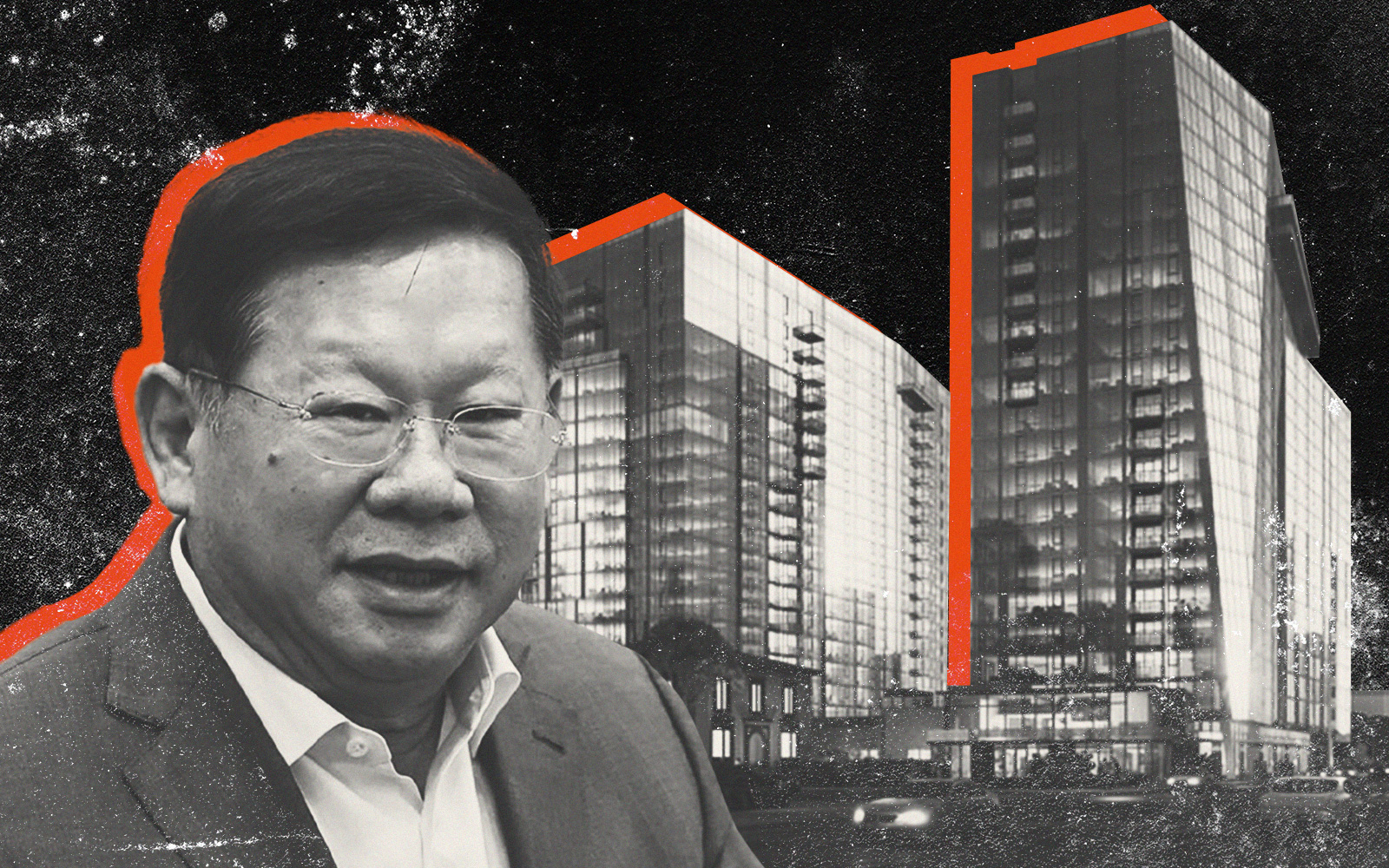

The Foster City-based developer, owned by disgraced Chinese developer Zhang Li, faces foreclosure for failing to pay homeowner association dues for unsold units at 188 West St. James Street, the San Jose Mercury News reported.

Li and his firm were at the center of a bribery scandal that sent Mohammed Nuru, former head of San Francisco’s Public Works Department, to prison.

With the scandal, Z&L projects stalled across the Bay Area, including the 640-unit double highrise on St. James. After completing the west tower, Z&L listed individual condos last spring for more than $500,000 each, with the total value of the unsold condos pegged at $300 million.

Z&L is responsible for paying the homeowners’ dues on condos that have been completed, but not yet sold. The delinquencies arose after the firm didn’t pay those HOA dues. The east tower stands vacant.

“It is absolutely mind-boggling that Z&L can’t resolve the HOA payments,” Bob Staedler, principal executive with Silicon Valley Synergy, told the Mercury News.

The county property documents show that Z&L has flopped into delinquency on at least 10 condos in the western tower as a result of the company’s non-payment of HOA dues.

“If your property is in foreclosure because you are behind in your payments, it may be sold without any court action,” the notices of default linked to the unsold condos state. The 188 West St. James Owners Association filed the default notices.

Z&L Properties also has failed to pay numerous subcontractors for construction work at the condominium highrises, while subcontractors have filed mechanic’s liens against the property. If unresolved, the subcontractors could potentially move toward foreclosure.

An HOA in California can pursue foreclosure and sale of a property to recoup the unpaid assessments and other costs related to the delinquency.

In 2019, the complex received a $330 million construction loan from Mack Real Estate Group to complete the project.

Read more

— Dana Bartholomew