240 years in prison. $180 million in penalties. Forfeiture of at least eight properties, including prime development sites in downtown Austin.

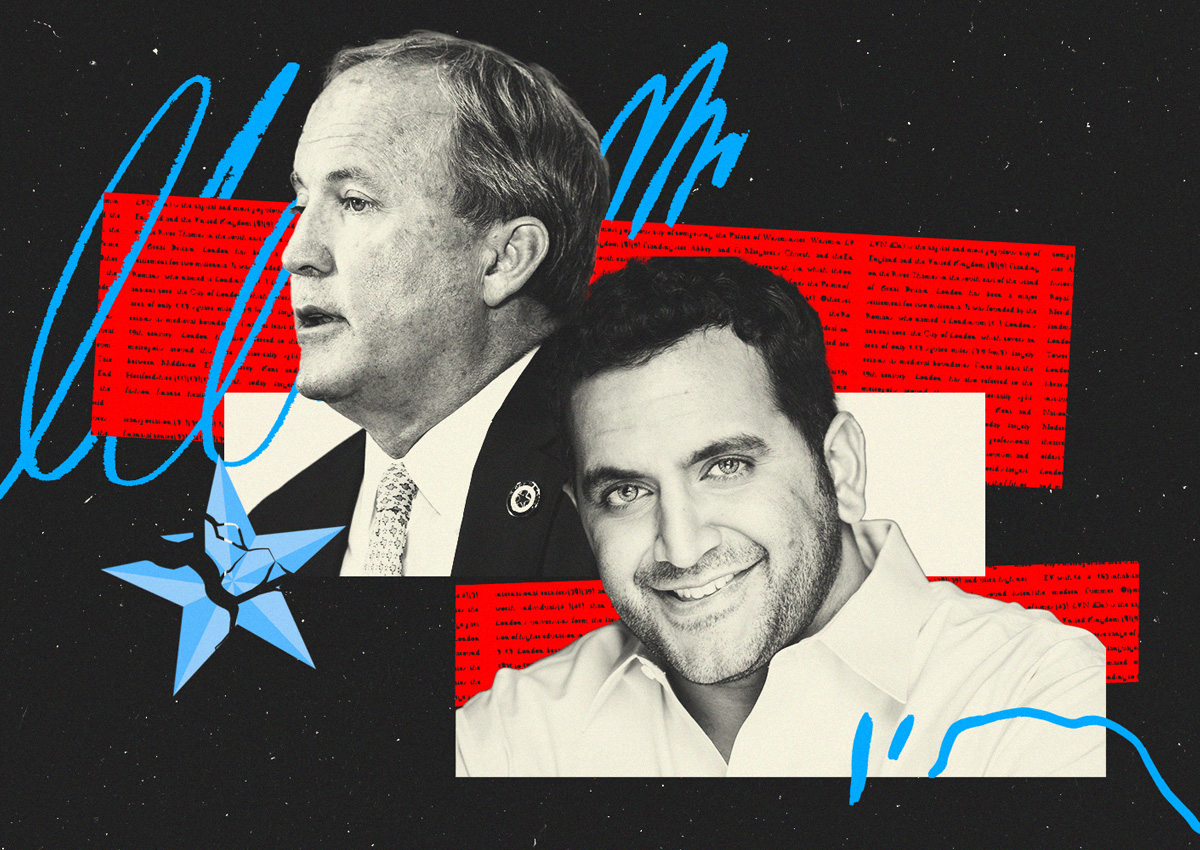

These are the potential consequences facing developer Nate Paul following his indictment this week on eight counts of making false statements to lenders. Each count carries a maximum penalty of up to 30 years in prison and a fine up to $1 million, and the prosecutors are also seeking to take control of the assets and $172 million in loans he scored from the alleged crimes, putting extreme pressure on Paul to strike a deal, potentially even testifying against Texas’ embattled Attorney General, Ken Paxton.

According to the indictment issued by a federal grand jury, Paul lied to lenders several times between March 2017 and April 2018 by sending them fraudulent financial statements inflating his cash holdings and diminishing the amounts he owed.

While the lenders Paul allegedly duped are not named in the indictment, TRD has determined most of their identities by cross-referencing prosecutors’ claims with Travis County real estate finance records.

The most common charge against Paul is that he supplied fraudulent financial statements to potential lenders during their due diligence processes. But he is also accused of hiding a partner in his acquisition of the 3M campus, long one of his most cherished assets. These are the lenders and the assets now wrapped up in the explosive case:

Ladder Capital Finance

In 2017, Paul was looking to make one of his biggest acquisitions yet, the 3M office campus in Northwest Austin. The property at 6801 River Place Boulevard spans 158 acres and includes several buildings.

To finance the deal, Paul sought out a $64 million loan from Ladder Capital Finance, a New York commercial REIT with $5.9 billion in assets, according to its website. Paul allegedly told Ladder that he had $25.3 million in “cash in banks” and owed just $3.4 million in liabilities, though he actually had at least $28.6 million more in liabilities and held “substantially less” than $25.3 million, according to the indictment.

Paul is also accused of sending Ladder a fraudulent organizational chart that suggested that he held 100 percent of the property ownership entity, Silicon Hills Campus LLC, when in reality, a Los Angeles-based firm owned 91 percent of another entity that directly controlled it. The LA investor, who could not immediately be determined, contributed more than $14.5 million toward the purchase of the property.

(The allegedly fraudulent organizational chart. Source: US District Court, Western District of Texas)

Calmwater Capital and an Irish real estate fund

In December 2017, Paul sought a $15 million loan for 56 East Avenue, a prime parcel in Austin’s Rainey Street district, from an Irish investment fund called U.S. Real Estate Credit Holdings. But while doing so, he allegedly provided fraudulent bank account summaries to Calmwater Capital, a Los Angeles real estate firm that was advising the Irish fund on the deal.

There was a huge deficit between what Paul said his bank account held and what it really held, according to the indictment. An account summary he emailed to Calmwater showed $14.2 million in the account. “As Paul knew, the document he sent was false and counterfeit,” and the account had less than $13,000, the indictment alleges.

(The allegedly fraudulent account summary. Source: US District Court, Western District of Texas)

(The allegedly legitimate account summary. Source: US District Court, Western District of Texas)

LoanCore Capital

At the end of 2017, Paul sought a $33.6 million loan for 105 West Riverside Drive, an office building near his Ego’s assemblage on South Congress. In similar fashion to the Calmwater situation, Paul sent LoanCore Capital, a lender in Greenwich, Connecticut, an account summary purporting to have $18.57 million, according to the indictment. However, prosecutors claim the account only held around $12,000.

Paul is accused of doing the same thing to LoanCore again in 2018, that time as he sought a $48.2 million loan for his ownership entities for 7620 Metro Center, 7401 East Ben White Boulevard and 8201 East Riverside Drive, all in Austin. That time, the account summary claimed $18.6 million while only actually holding $12,000, according to the indictment.

Amplify Credit Union

In March 2017, Paul was seeking loans totaling $9.2 million from Austin-based Amplify Credit Union on his properties at 707 Cesar Chavez Street and 8201 Burnet Road in Austin. When asked for his financial information, Paul allegedly told the credit union that he had $31.6 million in an account that in actuality held less than $500,000 in cash.

The Cesar Chavez plot, better known as the IHOP near Rainey Street, is one of the last remaining development parcels in the high-flying neighborhood.

Paul is accused of doing the same thing in March 2018 as he sought a $2.7 million loan for an industrial project. He allegedly said the firm’sliabilities only totaled $3.3 million, though they were actually at least $28.6 million.

Paul’s lawyer and representatives for the lender did not immediately return requests for comment.

On top of potential jail time, prosecutors are seeking forfeiture of all the properties connected to the offenses and a judgment of $172 million, the total of the loans Paul received from the alleged misdeeds.

Read more