Trending

Spare a quarter? Manhattan office rents less than 50 cents off from 2008 peak

Tight sublease market helping to foster rent growth despite higher availability: Colliers

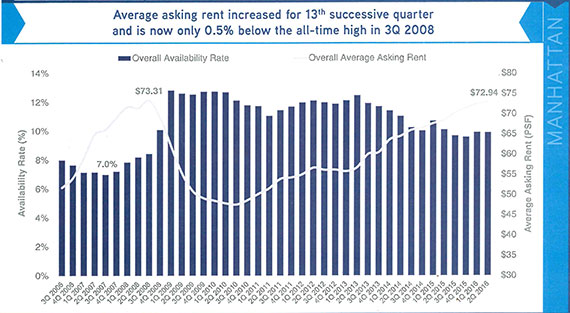

The average asking rent for Manhattan office space continued to climb during the second quarter to within pennies of the previous peak set back in 2008, according to Colliers International’s quarterly market report.

And even though there’s more availability than there was eight years ago, a relative lack of sublet space is helping put upward pressure on rents.

The average asking rent was $72.94 in the second quarter, continuing to approach the peak of $73.31 from back in the third quarter of 2008.

And even though the availability rate has stayed below 10 percent – a threshold Colliers uses to measure the equilibrium between a tenant-landlord marketplace – for four quarters, it’s still significantly above the 7 percent low set back in 2007.

Colliers‘ [TRData] Craig Caggiano said one reason that rents continue to rise despite the fact that there’s more availability has to do with a dearth of sublease space.

“Without this downward pressure on rents that sublet space creates, that’s one factor in why you’re not seeing a decrease in rents, even when there is higher availability,” he said. “Because there’s just not a cheaper alternative on the market from sublet space.”

The sublease availability rate has remained below 2 percent for a record 14 consecutive quarters, increasing slightly at 1.5 percent during the second quarter.

“In a 500 million-square-foot office market, it’s only about 7.5 million square feet of sublet space, which is not much for the tenants that are looking for it,” Colliers senior research Franklin Wallach added.

Leasing activity dropped 15.4 percent from the first quarter to 8.2 million square feet, but was 1.1 percent higher year-over-year. The largest transaction of the second quarter was Swiss bank UBS’ 891,000-square-foot renewal at 1285 Sixth Avenue.

Absorption was at .14 million square feet, the lowest level of positive absorption during a single quarter on record.

Average asking rents climbed to $83.09 in Midtown and $58.24 in Downtown, but dipped slightly in Midtown South for the first time since 2009 to $66.65.

“That was really because of some of the more expensive space coming off the market,” Wallach said. “But nonetheless, Midtown South is no longer at a record high, although it is still well above its 2008 previous high.”

Correction: Absorption during the 2nd quarter of 2016 for Manhattan was .14 million square feet. An earlier version of this post misstated the figure.