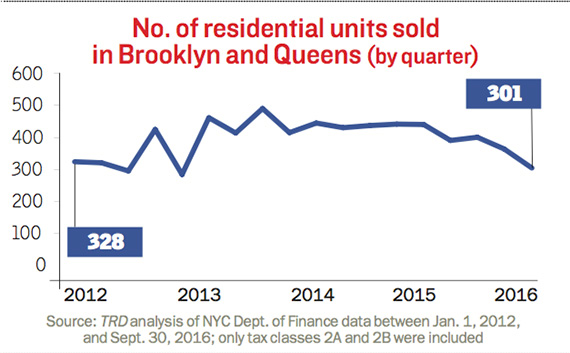

From the December issue: The total sales dollar volume in Brooklyn and Queens for small residential buildings — which has surged in the last five years — has seen its slowest quarter since 2013.

In 2012’s first quarter, the combined dollar volume for both boroughs was under $250 million. In 2016’s second quarter, it hit a high of more than $650 million but then dropped to around $475 million in the third quarter.

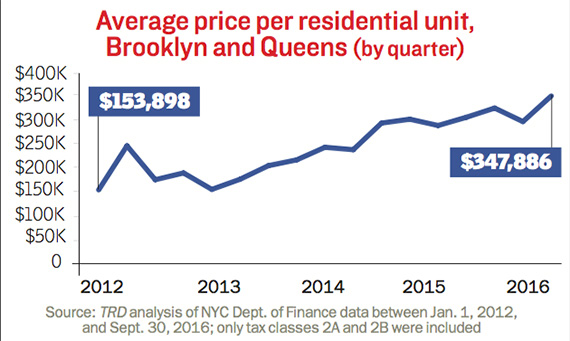

At the same time, the average price per unit more than doubled to $347,886 in the third quarter, from $153,898 at the start of 2012, a TRD analysis of city records showed.

“The owners [became] clued in that there is a new breed of buyer targeting the market,” said Adam Hess, a broker with TerraCRG, which according to CoStar Group handles a large number of small-building deals.

Marcus & Millichap’s [TRDataCustom] Shaun Riney, who is also active in the property type, said not all buildings are attracting the same level of buyer interest.

“Right now, the only assets that are really appreciating are fully vacant or fully free-market,” he said.

Hess, however, said he expects the market to pick up as smaller owners bundle their properties together for sale.

“A lot of owners realize they can extract a premium by packaging them together,” he said.