“Could I begin life again,” John Jacob Astor is said to have declared, “knowing what I now know, and had money to invest, I would buy every foot of land on the Island of Manhattan.” More than 150 years later, Astor’s lament still rings true for the dreamers who ply their trade in New York real estate. And their collective hustle, ambition and drama made for a riveting narrative in 2016.

The luxury market’s identity crisis deepened this year: Asking prices fell, plans were abandoned or put on ice, and banks said “No mas!” to financing new projects. The Real Estate Board of New York and unions sparred over the expiration of 421a, which dealt a body blow to the city’s investment sales market and to new rental projects, especially in the outer boroughs. The commercial brokerage world saw big upheavals, and the residential brokerage world saw its first-ever unicorn startup. And real estate and national politics came together like never before, with Donald Trump’s victory in the presidential election.

Read on for an in-depth look at some of the hottest stories to drop in 2016.

(Illustration by Fred Harper)

421a hits a wall

The year kicked off with a bang the industry didn’t quite expect — or want. Following a six-month extension in June 2015, the 421a tax abatement program officially expired in January. REBNY and the Building and Construction Trades Council of Greater New York couldn’t agree on a wage provision for construction labor at 421a sites. The failure to renew the program, which provides incentives to residential builders who set aside a portion of a project’s units as affordable, had a chilling effect on investment sales and new rental projects in the outer boroughs. It also put a spotlight on unions, who are facing increasing competition from nonunion shops.

On Nov. 10, it was announced the two sides finally settled on a wage provision. The agreement between REBNY and Building Trades was hailed as a “step forward for New Yorkers” by Gov. Andrew Cuomo. It seemed that both developers and affordable housing advocates could finally breathe a sigh of relief. But confusion over whether all 421a projects would receive the 35-year provision, or just those in prime development zones with higher wages for workers, boiled over less than a week later. And the legislature declined to fast track a new bill, pushing the issue to 2017.

The brokerage soap opera continues – and extends to commercial

Readers who thought brokerage drama was exclusive to residential firms saw some of the top investment sales brokers making the biggest moves of the year. Of course, Sotheby’s International Realty’s Brenda Powers and Douglas Elliman’s Toni Haber jumping to Compass came as big news, though Powers eventually returned to Sotheby’s after a brief stint at Town Residential. (Compass, of course, became the residential world’s first unicorn startup, hitting a $1 billion-plus valuation in August. And speaking of Town, Wendy Maitland’s clash with her former employer Joe Sitt played out in a very public way.) But it was Doug Harmon and Adam Spies’ defection from Eastdil Secured to Cushman & Wakefield that was, as TRD dubbed it earlier this month, “the poaching to end all poachings.”

From left: Bob Knakal, Doug Harmon and Adam Spies

Paul Massey

The top investment sales brokers in New York City, Harmon and Spies helped Eastdil broker nine out of the city’s 10 biggest deals in 2014. In 2015, Eastdil brokered a record $22.7 billion in New York City property trades, including the $5.3 billion sale of Stuyvesant Town and Peter Cooper Village. Harmon and Spies’ move to Cushman puts Eastdil’s dominance at the top of the investment sales heap under threat. But the incentives they’re getting at their new firm may also see some of Cushman’s stalwarts look for other opportunities. Bob Knakal renegotiated his contract at the firm to shorten it considerably, while his partner Paul Massey is making a run at City Hall.

From left: 432 Park Avenue (credit: DBOX), 220 Central Park South and One57

Resi, set, … wait

It was a sobering year in the luxury market, with sizeable discounts for pricey pads at new developments across the city. Developers who wished to add to the city’s luxury inventory found that banks were no longer willing to back them as easily as a year or two ago. Those who pushed ahead anyway, like Extell Development’s Gary Barnett, wandered into a labyrinth.

Captains of the universe still want what they want, however. There were a number of blockbuster deals that closed at 432 Park Avenue and One57, while 220 Central Park South reportedly convinced hedge funder Ken Griffin to shell out over $200 million for an apartment. A triplex penthouse planned at the project is asking a record-setting $250 million, and it’s still unclear if that’s the one Griffin is going for.

Captains of the universe still want what they want, however. There were a number of blockbuster deals that closed at 432 Park Avenue and One57, while 220 Central Park South reportedly convinced hedge funder Ken Griffin to shell out over $200 million for an apartment. A triplex penthouse planned at the project is asking a record-setting $250 million, and it’s still unclear if that’s the one Griffin is going for.

The boom is officially over, seems the general consensus among developers, who are now bringing more modestly priced product to market. However, even when it was in full swing, it looks to have been exaggerated. This October, TRD discovered that some of the industry’s more notable brokers and developers resorted to a little chicanery to make their projects more desirable. Our investigation showed that sales updates sent out via press releases or social media distorted the market for new development sales. On the plus side, our story concluded that the issue’s lack of oversight is an “easy fix” — that is, if the New York Attorney General decides to step up and punish the bad actors.

NYC’s dirty money files

In January, the U.S. Treasury announced it would start tracking cash purchases in Manhattan made by shell companies. The new disclosure law applies to transactions $3 million and up and requires title insurance companies to disclose the buyer’s true identity to the government. (Title insurance, however, is its own ethical quagmire, as TRD revealed in a March investigation.)

The order was an attempt to lift the veil of secrecy surrounding LLCs, which critics claim can be used to disguise money-laundering activities. However, the loopholes in the law were so huge that, according to one source, “You Can Drive a fleet of trucks through.”

Moreover, the new LLC disclosure law was focused on high-end residential purchases. It didn’t tackle an even murkier area, commercial real estate.

According to Treasury Department data, there were 9,528 suspicious commercial real estate transactions in the U.S. in a 10-year period starting in 1996, with half those cases coming from just five states (New York included.) Because traditional forms of financing were becoming hard to come by, especially for condo projects, developers started turning to outside lenders — including foreign funding sources — to get their projects off the ground.

According to Treasury Department data, there were 9,528 suspicious commercial real estate transactions in the U.S. in a 10-year period starting in 1996, with half those cases coming from just five states (New York included.) Because traditional forms of financing were becoming hard to come by, especially for condo projects, developers started turning to outside lenders — including foreign funding sources — to get their projects off the ground.

One of the more extreme cases, which TRD explored in an October cover story, involved money laundering from 1Malaysia Development Bhd, a Malaysian economic development fund that federal prosecutors say bankrolled Steve Witkoff’s Park Lane Hotel project on Central Park South. The scandal made international headlines, and involved a web of developers, global banks, political figures and even Leonardo DiCaprio.

(Illustration by Lexi Pilgrim)

Run this borough: Brooklyn’s Hasidic real estate investors

Manhattan real estate developers have become their own brand of celebrity. While these builders host power lunches and make Page Six with their dramatic divorces, their Brooklyn counterparts who hail from the insular Hasidic community remain very much in the shadows.

TRD’s August investigation into Hasidic real estate investors found they’ve spent more than $2.5 billion on acquisitions in five prime Brooklyn neighborhoods over the past decade, transforming the borough into the yuppie central it is today.

“The Hasidic community helped create the frenzy [in Brooklyn] we have today,” Pinnacle Realty’s David Junik said. “They let the market explode after that.”

Donald Trump (credit: Getty Images)

Trump 45, and the White House that Kushner built

Jared Kushner

Donald Trump staged the most stunning upset in modern U.S. politics when he was elected the 45th president of the United States. As Midtown Equities founder and Trump backer Joe Cayre said a day after the election, “They told me that I was crazy, that he would never win. We just kept on going.”

But Trump’s upcoming presidency puts a host of affairs into the spotlight. What happens to the Trump Organization? Though as POTUS he’s not legally obligated to cut ties to his companies, Trump faces unprecedented conflicts of interest heading into the White House. And how will the election affect the real estate industry? Trump has made promises to deregulate banks and enact tax cuts, factors that the industry is pretty chipper about (though a proposed overhaul of the tax system by Congressional Republicans has also stoked fears in the real estate community). And will the real estate buddies who stood by Trump benefit from him running the country?

Trump’s son-in-law, Jared Kushner, has been a major player on the New York development scene in recent years. But as Trump’s closest adviser and one of the key architects of his victory, he’ll now be sought after on the global stage.

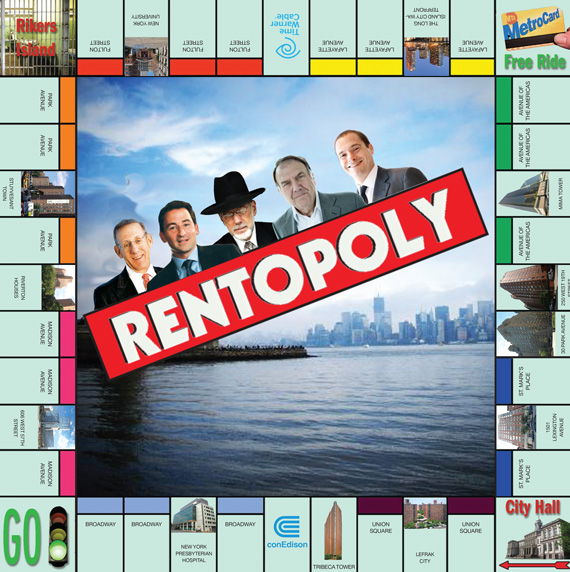

From left to right: Stephen Ross of Related Companies, Jonathan Gray of Blackstone Group, Ruby Schron of Cammeby’s International Group, Richard LeFrak of LeFrak Organization and Douglas Eisenberg of A&E Real Estate Holdings

Steve Ross

They built – or own – New York

In July, TRD did a first-ever ranking of New York’s 20 largest rental landlords, who collectively own more than 150,000 of the city’s approximately 2.2 million units. We followed that up in September with another first-ever ranking, this time of New York’s all-time most prolific condo developers. The 10 biggest developers added over 20,000 units to the city’s housing stock, and have formed dynasties in their own right. John Jacob Astor would’ve been proud.