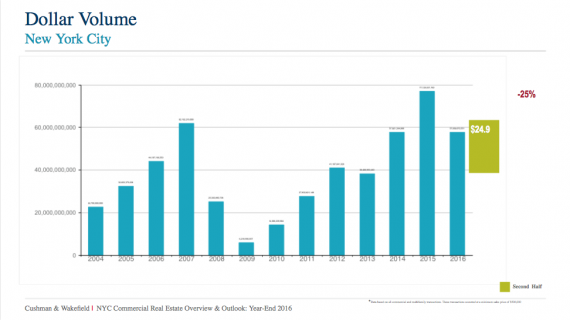

New York City’s investment sales market fell off 25 percent in 2016 to roughly $58 billion worth of property sales, according to Cushman & Wakefield.

The five boroughs’ total dollar volume of $57.8 billion last year was about quarter less than the $77.1 billion worth of sales in 2015, Cushman’s [TRDataCustom] Doug Harmon said Wednesday in his first news conference since joining the company from Eastdil Secured in October.

“That’s a pretty big drop on a relative basis from the year before,” said Harmon.

Despite the confidence that markets have shown following the presidential election, there’s still much uncertainty starting the new year, he added.

“Was that our 2008?” he asked. “Is 2017 going to be our 2009?”

Adding to the trepidation was the fact that the second half of 2016 ended slower than the volume seen in the first six months. If the entire year looked like the last six months, he said, the market might be down by about 45 percent.

But Harmon said he doesn’t see a steep cliff in 2017 because the market is more disciplined compared to 2008, and there’s still plenty of capital sitting on the sidelines.

“To me it’s very simple: The supply of cash and the strong desire to invest in Manhattan, especially trophy properties, far outweighs the supply of properties,” he said. “So if you look at volume falling off, I would argue it’s not just self-serving that if you have a piece of property that’s even average, I’d get it to the market now, because it’s going to shine in a better light when it doesn’t have a lot of competition in the market.”

Foreign investments actually fell off about 40 percent last year to $15.4 billion, though China increased its market share from 18 percent to 29 percent. And the Chinese took a bigger slice of the billion-dollar deal pie.

Harmon also noted a shift last year in buyers favoring big partial-interest deals, such as Allianz SE’s purchase of a 44 percent stake in 10 Hudson Yards.

In 2015, partial-interest deals represented 42 percent of Manhattan’s billion-dollar transactions, Cushman data show. In 2016, they accounted for 60 percent. Over that time span, foreign investors increased their share of partial-interest deals from 60 percent in 2015 to 67 percent in 2016.