L+M Development Partners’ preservation fund purchased a 90 percent stake in five Upper West Side rental buildings for $48.6 million, according to public records. The buildings are affordable housing currently enrolled in the project-based Section 8 program.

Four of the buildings compose a single apartment complex at 12-22 West 109th Street, less than one block from Central Park, and sold for $37.9 million, records show. The other property is an elevator building at 133 West 104th Street, which sold for $10.7 million. The two buildings together hold 125 units. The seller on both deals was the Manhattan Valley Development Corporation, a low-income housing nonprofit, and Richard Vasquez of Guttenberg, New Jersey.

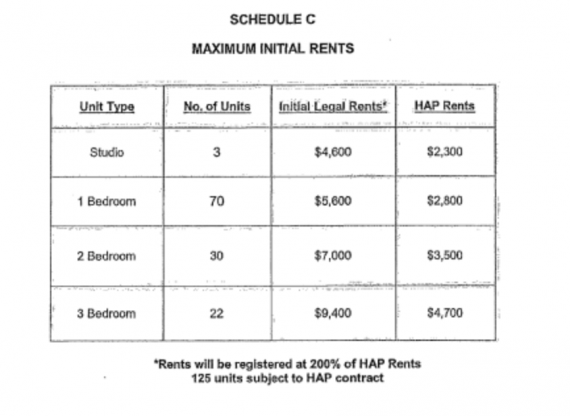

When contacted by The Real Deal, a spokesperson for L+M said the firm and MVDC would together invest up to $4 million in capital improvements to the properties. The new joint venture partners have already extended the project-based Section 8 rent agreement for 20 years, in addition to signing a regulatory agreement with the city. According to the rents included in the agreement filing, L+M and its partner can collect as much as $4,700 for a three-bedroom at the building through the federally-subsidized Section 8 program.

(Source: ACRIS, click to enlarge)

HAP stands for Housing Assistance Program, in this case Section 8.

The stated mission of L+M’s preservation fund is “to acquire and rehabilitate properties at risk of becoming unaffordable to low to-moderate income households.”

The interests MVDC sold would appear to account for about 16 percent of its current management portfolio, according to figures posted on the group’s website.

This is L+M’s only recent Upper West Side acquisition of note, although the company, one of the city’s most prolific builders, has been active all across the New York City Metro area of late. The developer recently bought an office building in Downtown Newark, New Jersey with plans for residential conversion. And it’s also planning a two-skyscraper residential development in Two Bridges with CIM Group, with 25 percent of the units in the 730 and 800 foot towers pledged affordable. A 59-story tower in the Financial District and affordable components of a 5,500-unit plan in Greenpoint are also on the build.