WeWork grows up: WeWork brought in some adults to help manage the $16.9 billion playground. James Woods, the head of the Brooklyn Bowl, came on board, as did Richard Gomel, a former executive at Starwood Capital and Junius Real Estate Partners. The company has been restructured into four divisions – co-working, co-living, services and an enterprise business catering to big corporations – and sliced into geographic areas.

It’s a structure common among public companies or large corporations aspiring to go public, which is where many see WeWork heading. But to get the public markets excited, the company needs to show serious growth, and recover from blows sustained last year when it was revealed in leaked documents that it slashed its profit projections by 78 percent.

Co-living is for kids and losers: “I’m sorry, but if you live with 10 people and you share breakfast or lunch… where do you go with your girlfriend?”

So said Stonehenge Partners’ Ofer Yardeni at a multifamily panel last week, taking on companies such as WeWork and Common, which are betting that 20 and 30-somethings will pay premium rents to live dorm-style in urban hotspots. There might have been a tinge of self-preservation behind his comments – Stonehenge is, after all, one of the city’s largest owners of traditional rental housing.

Yardeni has done this before. In 2015, he declared that if Billionaires’ Row were a stock, he’d happily short it. As far as I’m aware, his remarks weren’t publicly challenged by the developers building glitzy product on 57th Street. But this time, he’s accepted a challenge to debate his views on co-living with the CEO of Common, Brad Hargreaves. They’re squaring off at 3p.m. on March 13 at TRD’s Hudson Yards office – stay tuned for more details.

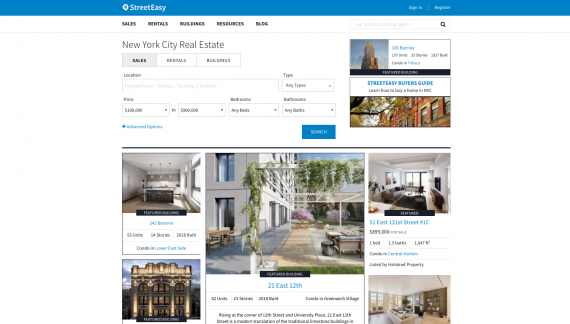

StreetEasy

First you get the platform, then you get the power: Looking for a place to buy in New York? Chances are, your first stop is StreetEasy. The online listings platform, which Zillow bought for $50 million in 2013, is one of the few destinations in New York City’s notoriously walled-off property market where buyers can compare homes and prices. As a result, it’s where brokers want their listings to

But what happens when the very brokers fueling StreetEasy’s database are bypassed? On March 1, the company is rolling out an advertising feature that would, by default, connect prospective homebuyers with agents who’ve paid StreetEasy for the privilege. That risks bypassing the brokers who hold the exclusive listing on the property, who may be forced to split their commissions with the so-called “premier agents” to get the deal done. (Listings at new development buildings and those priced over $10 million are excluded from the “premier agents” program.)

Brokerages are now grappling with the beast they’ve fed all along. Some are considering an all-out boycott, while others are pushing the under-development REBNY MLS to become a consumer-facing alternative to StreetEasy (though my money’s on that MLS becoming real estate’s answer to the Calatrava Oculus, an expensive boondoggle).

The brokerages vs. StreetEasy dilemma mirrors the one the news business is going through with the likes of mega-platforms such as Facebook. If publishers play ball, their articles live on Facebook and aren’t theirs to control. If they don’t, there’s a good chance that the stories won’t be seen by a growing cohort of people who get their news almost exclusively from Facebook.

Imagine a conversation between a seller and a listing broker in which the broker tries to justify why the listing isn’t on StreetEasy. It’ll be a tough one.

Shlomi Reuveni

Shlomi sues Town: Town Residential is facing a $16 million lawsuit from its longtime head of new development, Shlomi Reuveni, who left the firm in December. While details of the suit remain scanty, sources told TRD’s Kathy Clarke that Reuveni is challenging a noncompete agreement that would bar him from working for a Town competitor.

“In a desperate attempt to paint a false record, Town has refused to live up to its obligations,” Reuveni said. For his part, Town founder and CEO Andrew Heiberger is confident his firm will prevail in the battle –In 2014, the firm won a similar suit against Nicole Oge, who went on to become the top marketing person at Douglas Elliman.

“The good news is that I have been through this before and always won,” Heiberger said. “But the bad news is that I have been through this before.”

In general, the industry is still trying to sort out how to deal with noncompetes for executives and top brokers – with leaders at firms waiting to see what precedents will be set by lawsuits such as the one between Elliman and its former star agent Leonard Steinberg, now at Compass.

“I think people are interested to see if any of these things will hold up,” said Brown Harris Stevens’ Bess Freedman in November. “And what it could potentially mean for them if there’s repercussions or not.”

(Paydirt is a weekly column that riffs on the biggest NYC real estate news of the moment, providing analysis and historical context on the deals and players that make this town tick. Read more from Paydirt here.)