Trending

In Manhattan luxury, the $4M-$6M market still reigns supreme

Nearly half of luxe contracts signed this year are in that range: Urban Digs

“Cheap” luxury is having a moment. Contracts are up, and the $4 million-to-$6 million market is seeing the most action.

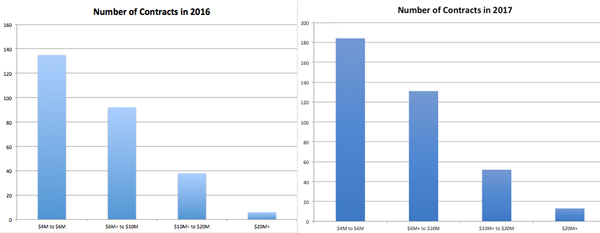

In total, 383 contracts were signed on Manhattan pads asking $4 million and above in the period from Jan. 1, 2017 through March 31, 2017, according to data collected by real estate analytics website Urban Digs and reviewed by The Real Deal. That’s compared to 271 contracts inked during the same period in 2016 — representing a 41 percent jump year-over-year.

The majority of those contracts — a total of 186, or nearly 49 percent — were for units asking between $4 million and $6 million, the data show. During the same time period of 2016, that section of the market also saw the highest level of activity, with 135 contracts signed, nearly 50 percent of luxury deals inked in that quarter. Urban Digs’ data is based on listings pulled from the REBNY listing service, and it should be noted that because contracts don’t hit public records, the data cited in this report may not include some signed deals.

Douglas Elliman’s Frances Katzen says she’s noticed a rise of activity in the lower tier of the luxury sector. “I am seeing bidding wars on resales between $4 million and $5.5 million,” she said, noting that the “next luxury sector” is between $6 million and $8 million.

Every sector of the luxury market saw an increase in contract signings, according to Urban Digs’ data. For units asking between $6 million and $10 million, a total of 132 contracts have been signed so far this year, up from 92 during the first quarter of last year. In the $10 million – $20 million market, 52 contracts were signed — 14 more than in the same period in 2016. The over-$20 million market even saw twice as much activity as it did in the first quarter of 2016 — with 13 contracts signed between Jan. 1 and March 31, compared to six in the first quarter of 2016.

Urban Digs’ Noah Rosenblatt pointed out the first few months of 2016 were particularly sluggish in terms of contract activity. “The first quarter of 2016 was a trough, it was the bottom of the weak cycle,” he said. “Whenever you compare a year-over-year period to what ultimately turns out to be the bottom of the down-cycle — you will see a bump.”

Recent reports show tentative signs of recovery in the city’s luxury market, with several brokerages celebrating a jump in luxury deals. Figures from Olshan Realty, for example, show the total sales volume in the over-$4 million market in the first 13 weeks of 2017 at $2.5 billion, up from $1.9 billion during the same time period of last year. But it’s taking longer to sell luxury pads. A luxury unit that went into contract during the first quarter this year spent an average 390 days on the market, a 39 percent increase from last year, according to Olshan.

Olshan’s figures show that the median asking price slipped too, falling from $6.5 million in the first quarter of 2016 to $6.2 million this year — a 4.6 percent decrease. The average price was lowered by 7 percent before going into contract, compared to 6 percent in the first quarter of last year.

“[Buyers’] stock portfolio is higher, they are seeing prices are more negotiable, and they are coming off the sidelines,” brokerage president Donna Olshan said, adding that figures indicate sellers are getting prices that are at least 12 percent lower than the original asking price.

Jonathan Miller, of appraisal firm Miller Samuel, agreed that increased contract numbers demonstrates sellers’ shifting mindsets. “The reason is not that buyers are willing to pay more,” he said. “It’s that sellers are willing to negotiate more. The seller is traveling further to meet the buyer.”

Derek Smith contributed to this story.