Trending

Isaac Kassirer sells six-building Bronx portfolio to Pistilli Realty for $39M

Astoria-based firm acquires piece of “Continental” package that last traded in 2015

Pistilli Realty Group picked up a six-building multifamily portfolio in the north Bronx from Isaac Kassirer for $38.5 million, or $206 per square foot, the firm told The Real Deal.

Seth Glasser

The package contains 209 rent-stabilized apartments and spans 186,520 square feet.

Kassirer’s Emerald Equity Group owned the properties since October 2015, when he bought them as part of a larger portfolio purchase with Eli Bleeman’s Asden Properties and others. The 13-building, 612-unit “Continental” portfolio, which the group bought from JPMorgan Chase and Continental Properties for $90 million, was divvied up among the individual buyers.

Property records show Kassirer paid a combined $28.4 million for the six buildings in 2015.

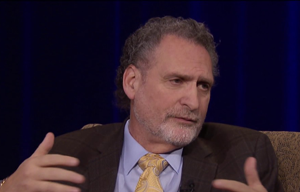

Joseph Pistilli (credit: “BuildingNY” via YouTube)

Pistilli, an Astoria-based investment firm led by the Pistilli family, “assumed the existing mortgages from New York Community Bank” in order to close the deal, said Marcus & Millichap’s Seth Glasser, who represented the buyer.

The addresses are 2442 Morris Avenue; 2226, 2322 and 2333 Loring Place North; and 1715 and 1727 Walton Avenue.

Further reading on Aaron Jungreis including stories and deals

Marcus & Millichap’s Seth Glasser, Michael Fusco, Peter Von der Ahe and Joe Koicim represented Pistilli, and Rosewood Realty Group’s Aaron Jungreis represented Emerald. Jungreis and Kassirer declined to comment.

The properties are among the first that Kassirer has sold since going on a buying spree, which including the $357.5 million purchase of the 47-building Dawnay Day portfolio in Harlem and the $140 million purchase of a 38-building portfolio in the Bronx.

Pistilli has been an active Bronx buyer, having last year paid $55 million for more than 300 apartments in the Fordham Manor neighborhood.