If StreetEasy wanted to test the loyalty of the city’s rental agents, they have their answer.

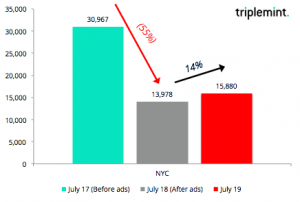

Within 24 hours of introducing a new $3-per-day fee for rental listings, the number of rentals posted on StreetEasy’s platform plummeted 55 percent from 30,967 on Monday to 13,978 on Tuesday, according to inventory data obtained by The Real Deal. The figure rebounded slightly by Wednesday morning to 15,880 rental listings, according to an analysis by brokerage Triplemint.

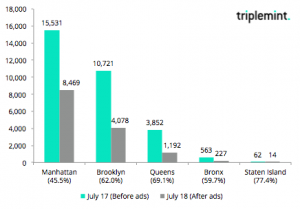

In Brooklyn, the number of listings fell from around 10,721 on Monday to 4,078 on Tuesday — a 62 percent decline, Triplemint’s data shows. Manhattan dropped 45.5 percent from 15,531 rental listings on Monday to 8,469 on Tuesday. Queens experienced a 69 percent drop, with the number of listings falling from 3,852 on Monday to 1,192 on Tuesday.

Although the fall in listings was expected, the purge reflects that it’s largely up to individual agents to decide whether to feed their listings to StreetEasy, whether or not their firm sends listings en masse.

Compass’ Gabriele Sewtz said she was withholding her rental listings on ethical grounds. “I don’t feel that one player in a market should have the power to decide what a consumer is going to see and what a consumer is not going to see,” said Sewtz, who is marketing a Crown Heights two-bedroom for $2,500 and a unit in Dumbo asking $8,500. She added that StreetEasy’s language around the fee — opting in — put the onus on agents when, in fact, the website took listings down if they didn’t receive payment.

“StreetEasy decided from one night to kick almost 50 percent of the inventory to the curb,” she said. Her sales listings still appear on StreetEasy.

Rental inventory on StreetEasy between Monday, July 17 and Wednesday, July 19. Graphic provided by Triplemint

But Nest Seekers International’s Jessica Campbell — whose listings include a $7,500-a-month penthouse in Chelsea and a three-bedroom in Turtle Bay asking $32,000 — said she’ll fork over the $3 a day per listing because her clients deserve maximum exposure.

“I simply had no other option, though I don’t appreciate being backed into a corner so I am not pleased by this per-day fee,” she said. “Getting that notice felt like a ransom note and I had no option but to pay it.”

Corcoran Group agent Brian Meier will also opt in. “I’ll stop paying StreetEasy when it’s not worth it anymore,” he said. Meier predicts that could happen soon. “Renters understand that StreetEasy is not a platform to see the whole market,” he said.

For those tracking StreetEasy’s listings on Tuesday, the numbers dipped early in the day but ticked up with each passing hour — presumably as agents got on board with the “NYC Rental Network.” As of 6 a.m. Wednesday, there were 15,885 listings on the website, a number that climbed to 16,005 by noon.

In a statement, Susan Daimler, general manager at the Zillow-owned StreetEasy, said they’d anticipated a drop in listings. StreetEasy said a key goal for the new network — which offers a single point of entry for agents’ listings — is to “wipe the slate clean” by removing stale or inaccurate listings from the portal. Agents who opted in to the program over the past 24 hours have done so across price points and boroughs, StreetEasy said.

Rental inventory on StreetEasy by borough between Monday, July 17 and Tuesday, July 18. Graphic provided by Triplemint

Not everyone thinks StreetEasy will rebound after losing such a large number of listings. “Consumers will now have access to less inventory,” said Philip Lang, COO of Triplemint. Others, remembering the backlash against Craigslist when the website introduced a paywall, predicted StreetEasy wouldn’t survive with a pay-to-play model for the rental market.

Many of the city’s biggest firms are pushing back against StreetEasy. They’ve described the new per-diem fee as a “tax on agents.”

On Tuesday, the Corcoran Group and Citi Habitats — both owned by Realogy’s NRT — stopped sending their feeds to StreetEasy, Corcoran CEO Pam Liebman said.

Individual agents may spend their own money sending their listings to StreetEasy, but on Tuesday less than 7 percent of Corcoran’s rental listings were on the website, Liebman said. Around 20 percent of Citi Habitats’ rental listings were posted, she noted.

Douglas Elliman, however, chose to break away from the pack and support the program by letting agents use their ad budgets to pay for it,

“StreetEasy is our biggest driver of traffic, other than our own site, to our listings,” Elliman COO Scott Durkin said last week. “There was no way we were going to let that feed be interrupted. It was a smart business decision.”

Sensing an opening in the market, the startup Leasebreak sought to capitalize on the drama Tuesday and bought up a domain “breakupwithstreeteasy.”

“StreetEasy assumed it could take advantage of real estate agents because of the traffic to its website,” said Phil Horigan, founder of Leasebreak. “It grossly miscalculated and it will pay the price.”