Trending

Westchester & Fairfield Cheat Sheet: Stamford’s largest empty office space sells for $33M, developers in Yonkers ordered to abide by union labor rules … & more

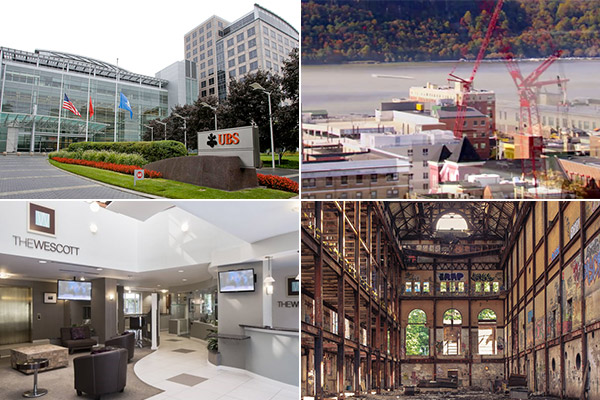

Former UBS site, Stamford’s largest vacant office complex, sold for $33M

The 700,000-square-foot office complex that once housed UBS has sold for $33 million. The buyer is Stamford Washington Investors LLC, an affiliate of the California investment firm that previously bought the property’s mortgage. UBS once had 4,200 workers in Stamford. The last of the 900 UBS employees who remain in the city moved from 677 Washington Boulevard to A Property Across The Street at 600 Washington Boulevard last year. [Stamford Advocate]

Developers who get tax breaks in Yonkers must follow union labor rules

The Yonkers Industrial Development Agency approved rules that will force developers to abide by union project labor agreements at properties that receive financial assistance. Labor unions have been critical of developers and city officials because projects that enjoyed public funding or tax breaks often employed cheaper out-of-state labor, they claim. The one-year pilot program applies to developments with construction budget of more than $5 million. [Lohud]

The Wescott apartments in Stamford sell for $67M

TH Real Estate (an affiliate of Nuveen, a TIAA company) sold The Wescott apartment community for $67 million to a private New Jersey-based investment group. The 261-unit residential property on Washington Boulevard also has 8,500 square feet of vacant commercial space. Built in 1986, The Wescott has been renovated over the last five years, with most of the apartments featuring new kitchens and bathrooms. [Real Estate Weekly]

Glenwood Power Plant in Yonkers gets $1M development grant

The redevelopment of the Glenwood Power Plant on the banks of the Hudson River in Yonkers got a boost with a $1 million grant from the Mid-Hudson Development Council. Built in 1907 to power the railroad, the cavernous facility was abandoned in the 1970s. The Lela Goren Group bought it in 2012 with a $15.7 million plan to preserve the historic structure and turn it into a cultural center. “Phase I” of the conversion, which included stabilizing the structure and doing priority utility work, was completed this year. [City of Yonkers]

Sale of Linden Court mansion in Greenwich gives hope for luxury market

Linden Court, an eight-bedroom 12,390-square-foot mansion in Greenwich, sold for $9.65 million after sitting on the market for nearly eight years. The five-acre property within the exclusive Khakum Wood Association area was originally listed for $25 million in 2013. Local real estate experts hope this long-delayed and price-reduced luxury sale is another sign of the recovering luxury market in Fairfield County. David Ogilvy of David Ogilvy & Associates, which represented both the buyer and the seller, told Greenwich Time, “It’s hard to put a number on any of these markets, but we’re happy with what we’re seeing.” [Greenwich Time]