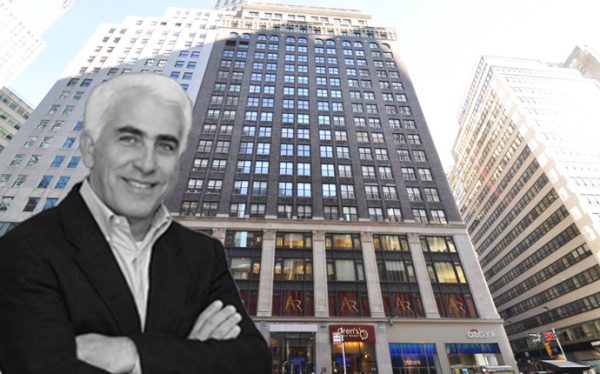

Los Angeles-based CIM Group landed a $360 million loan to close on its $520 million purchase of 1440 Broadway, one of the last buildings in the dwindling New York REIT portfolio.

The Blackstone Group provided the financing to CIM Group. The deal closed on Tuesday, and the floating-rate debt has a five-year term, the Commercial Observer reported. The loan was made at a 60 percent loan-to-cost. The Real Deal first reported news of the building going into contract in November.

CBRE and Eastdil Secured co-arranged the financing play and also co-marketed the property for sale.

The 25-story, 749,000-square-foot property is 40 percent leased, sources told TRD in November, and the Los Angeles-based buyer plans to focus on leasing the remainder of the space.

New York REIT has been liquidating its holdings following a campaign by activist investors and an accounting scandal at American Realty Capital Properties, which formerly was in control of the REIT.

Blackstone has had a busy month as well, purchasing a 49 percent stake at One Liberty Plaza from Brookfield Property Partners earlier in December for $1.55 billion. [CO] – Eddie Small