Amid 2017’s market turmoil, residential firms ramped up recruiting — while agents jockeying for sweeter commission splits happily complied.

Things came to a head in early December, when Compass — fresh off a $450 million investment from Softbank — vowed to use the funds to turbocharge its growth both nationally and in New York.

By the end of the month, the firm, which is headed by CEO Robert Reffkin, had hired 50 more agents in Manhattan to close out the year with 713 agents in the borough, up from 300 in 2016.

“The word ‘slow’ is not part of the Compass vocabulary,” said Maelle Gavet, the COO of the firm, which is now valued at $2.2 billion.

Among the firm’s big-name hires were Halstead Property’s Brian Lewis, Nest Seekers International’s Silvette Julian and Corcoran’s Fabienne Lecole.

But unlike 2013, when Compass’ aggressive hiring caught its rivals off guard, this time the upstart firm wasn’t the only one in recruitment mode.

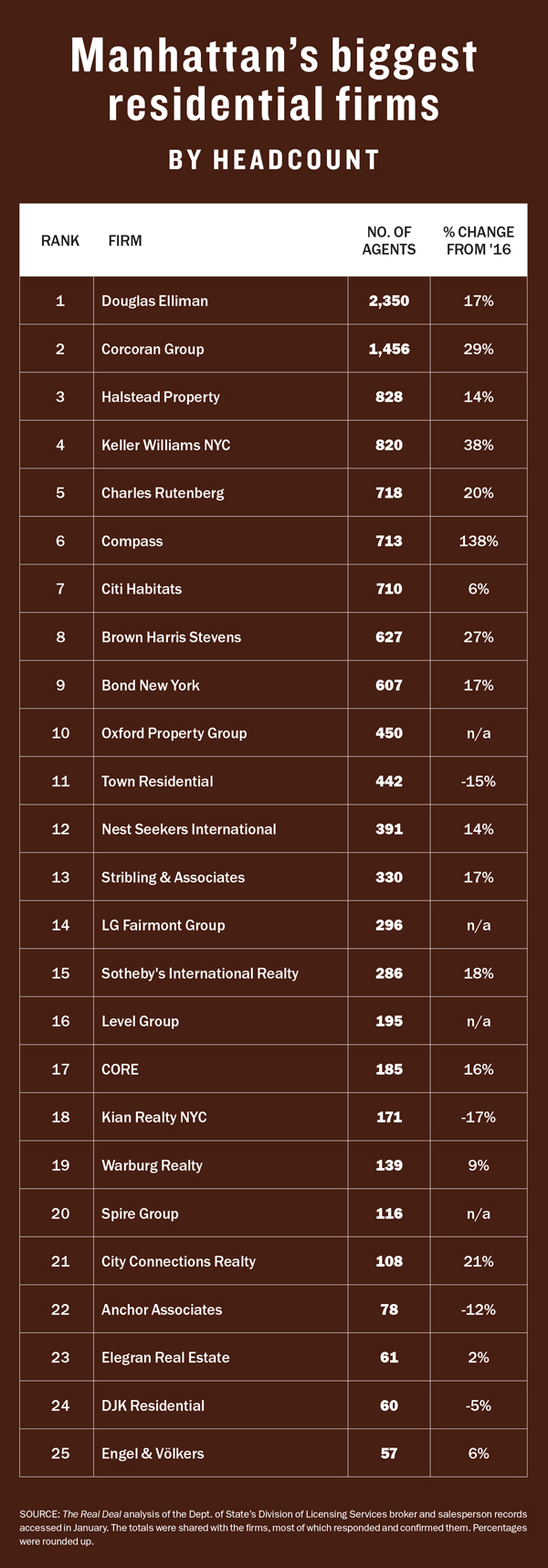

Those efforts were evident in the firms’ headcounts, which TRD determined by reviewing broker licensing records filed with the state Department of State.

Taking the No. 1 spot on that portion of the ranking was Elliman with 2,350 Manhattan agents, up 17 percent from 2,010 in May 2016.

It was followed by Corcoran with 1,456 (up 29 percent) and Halstead Property with 828 (up roughly 14 percent).

In the No. 4 spot was Keller Williams NYC — part of the fast-growing national franchise — whose 38 percent gain was second only to Compass, whose headcount jumped 138 percent. KWNYC finished the year with 820 agents, up from 593.

“Agents know it’s a challenging market, so they’re looking to make sure they’re at the right place,” said Steven James, CEO of Elliman’s New York brokerage. “They’re independent contractors, so if they don’t make sales, they don’t get paid.”

For Corcoran — as well as sister firms Citi Habitats and Sotheby’s — the hiring spree was a tactical move started in February 2017 by parent company Realogy, which on Jan. 1 brought in new CEO Ryan Schneider.

And Realogy’s three NYC brands are still in growth mode.

Corcoran CEO Pam Liebman — who hired new development guru Vickey Barron from Elliman in 2017 — said that in the last year the firm “really gave an extra push” on the recruiting front.

And even firms that haven’t historically been aggressive at wooing new agents ramped it up in 2017.

“Our focus has never been about size,” said Hall Willkie, who runs Brown Harris Stevens with Bess Freedman. “It’s about being good.”

Nonetheless, Freedman said the white-shoe firm has made a concerted effort over the last year to target and groom new brokers. In 2017, it increased its headcount by 27 percent, adding more than 130 agents for a total of 627.

“At some point, you have to be willing to embrace the fact that the future is getting younger,” she said. “We want the older generation meshed with the new.”

Sources said the unabashed recruiting is the new normal.

Three years ago, as firms poached top agents from rival brokerages, those tactics spawned a series of lawsuits over noncompete agreements. While that era of litigation seems to have subsided, ruthless poaching — now involving lesser-known agents — has not.

“Every one to three years, when residential agents’ contracts expire, they are openly shopping around the deal they have with the competition,” said Andrew Heiberger, CEO of Town Residential.

Still, in 2017, Town was one of the only big firms whose ranks shrank — contracting by about 15 percent to 442 from 523 in 2016. Heiberger called the lack of loyalty among agents “disheartening” and “hurtful.”

“One of the reasons I take it more personal than most is I’m the owner and founder,” he said. “I have skin in the game.”

Another brokerage head said startups like Compass — and before that Town, which launched in 2010 — changed “the rules of engagement” in the residential world.

“It changes the mentality of agents,” said the executive, who asked to remain unnamed. “A lot of agents who haven’t earned certain splits or credibility, or don’t have the book of business to qualify for those terms, are getting them anyway.”

Gavet acknowledged that Compass’ venture-capital war chest is key to the firm’s recruiting operation. But she said it’s “not for the reasons usually mentioned in the press,” referring to Compass’ reputation for big bonuses and high splits.

“It means we can go faster in financing new offices, we can hire staff faster, we can really invest more in our technology, we can invest more in our agents,” she said.

To that end, in 2017, Compass opened three new NYC offices — on the Upper West Side, the Upper East Side and Cobble Hill. It now has a total of 150,000 square feet citywide, including 115,000 square feet at 90 Fifth Avenue, where it occupies seven of the building’s nine floors. And Gavet said the company is considering opening in Brooklyn Heights and Bed-Stuy.

Several established firms, however, said it’s not financially worth it to collect warm bodies.

Halstead’s Diane Ramirez said she doesn’t entice new recruits with unsustainably high splits. And Warburg Realty’s president, Clelia Peters —whose firm closed $202.5 million in sell-side deals with 139 agents — said the math for hiring high-profile agents doesn’t usually work.

“The economics of recruiting star agents is more about marketing than helping the bottom line,” said Peters, who noted that Warburg has a “significant” roster of agents who consistently produce. “That’s a group of agents that’s generally ignored by many of the largest firms.”

Smaller firms, in particular, have a lot riding on strategic hires.

Mike Greenberg, CEO and general counsel of the 195-agent Level Group, said hiring the right broker is key to profitability in a tough sales environment.

“We’ve been very careful to hire new agents to our firm who are experienced and capable,” said Greenberg, whose firm ranked No. 25 on the closed-deal ranking with $33.7 million in sell-side sales. “By raising the percentage of agents who are productive, it’s helped the bottom line of the firm.”