Lennar scores approval for Stamford luxury apartment project

A 16-story luxury apartment development will replace a cylindrical tower across from city hall in Stamford, the Stamford Advocate reported. Members of the zoning board unanimously approved the project from Miami-based developer Lennar, the largest homebuilder in the U.S. The building currently on the site, St. John Tower A, has been vacant for three years and is set to come down in the fall. Lennar was able to avoid affordable housing requirements for the project by paying $4.3 million to the current owner that structure and nearby towers B and C. The remaining two towers contain 240 affordable housing units and the payment will go towards their refurbishment, a St. John rep said. [Stamford Advocate]

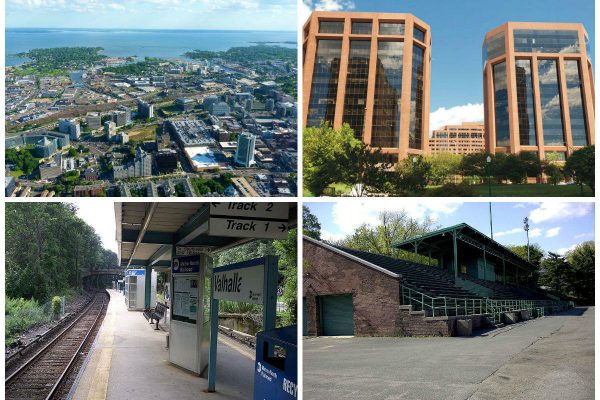

Ginsburg secures $120M loan ahead of Westchester Financial Center redevelopment

Developer Martin Ginsburg has lined up $120 million in financing as part of his plan to redevelop the Westchester Financial Center in White Plains, the Westchester County Business Journal reported. Ginsburg’s Ginsburg Development Cos. and Robert Martin Co. bought the two office buildings for $83 million in April and plan to combine them with an apartment building to create a concept called City Square, which “includes apartments, green space, restaurants, retail and renovated offices,” according to marketing materials on the project. Avison Young’s New York capital markets group arranged the loan. [WBJ]

GHP Office Realty buys former SL Green buildings in Valhalla for $12M

GHP Office Realty has snapped up SL Green Realty’s office buildings in Valhalla for $12 million, the Westchester County Business Journal reported. SL Green announced that it sold the properties at 115-117 Stevens Avenue last month, but hadn’t disclosed the buyer. The purchase builds up GHP’s Westchester County portfolio, which includes a 280,000-square-foot building in the Tarrytown Corporate Center and an 80,000-square-foot warehouse in Elmsford. [WBJ]

Two medical tenants sign long-term leases in Greenwich medical hub

A skincare center and an ophthalmology clinic are moving into an area that’s become a “hub for medical services,” according to the Fairfield County Business Journal. Connecticut Dermatology Group and Coastal Eye Surgeons have both signed long-term leases at a building on Putnam Avenue in Greenwich, with the former leasing more than 6,000 square feet of space and the latter leasing 4,300 square feet. The building is near several medical centers, including Greenwich and Stamford hospitals. [FBJ]

Trio of projects bringing senior and assisted-living housing units to Fairfield

More than 200 senior and assisted-living housing units are heading to Fairfield within the next few years, as part of three projects that are in development, the Connecticut Post reports. Sunrise Senior Living, Sturges Ridge and Maplewood at Southport will all offer new units within the next few years, including units for people with Alzheimer’s and dementia. The developers “are responding to a need within not just Fairfield but the surrounding area,” Fairfield’s economic development director Mark Barnhart said. [CTPost]