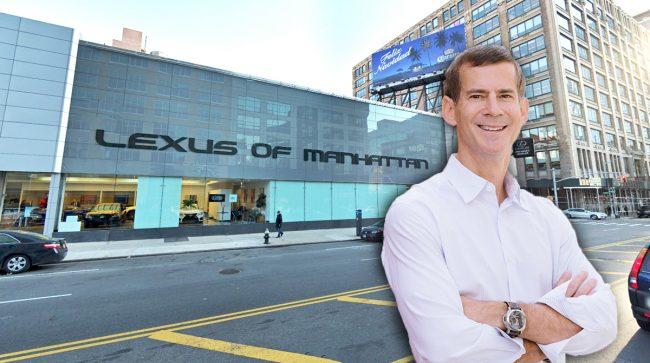

Ironstate Development principal Michael Barry and 646 11th Avenue (Credit: Google Maps)

UPDATED, Thursday, June 14 at 4:58 p.m.: CBSK Ironstate has scooped up a debt-and-equity package totaling more than $250 million for its 12-story, 222-unit condominium project in Hell’s Kitchen.

The company — a partnership between Ironstate Development, CB Developers and SK Development Group — secured a $181 million construction loan from Deutsche Bank and $70 million in preferred equity from Boston-based hedge fund Baupost Group.

CBSK and JLL, which brokered both deals, confirmed them to The Real Deal, but declined to identify the new equity partner. Sources however said it is Baupost, which has also invested in the redevelopment of 441 Ninth Avenue.

Simultaneously, CBSK also closed on the $93 million purchase of the two-story Lexus dealership on the site at 646 11th Avenue. They had been in contract since December.

The site spans the full block between West 47th and 48th streets, where Lexus would remain. Plans call for a new structure, with 161,000 square feet of apartments, 40,000 square feet of pre-sold retail space and 60 for-sale storage units. CBSK would build out the ground floor and basement, and sell it back to Lexus.

The Japanese automaker paid about $30 million for the forthcoming commercial condo, said Ironstate Development’s Michael Barry.

With the debt and additional equity in place, work has begun at the site. Demolition began earlier this month, and the project is slated for completion by late 2020, Barry added.

A JLL team led by Aaron Appel, Keith Kurland, Jonathan Schwartz and Doug Baillie brokered the debt-and-equity package.

“The future of the area is being re-shaped with around 17 million square feet in retail, commercial and residential space underway,” Appel said in a statement. “This transaction offered the lenders an opportunity to finance one of New York’s most experienced residential developers in a project with significant risk mitigation.”

The three firms have also partnered on the development of residential properties such as 10 Bond Street, the Lindley at 591 Third Avenue, and Chelsea 29 at 221 West 29th Street.

Correction: A prior version of this story incorrectly stated that Baupost invested in 111 West 57th Street. Though Baupost offered to invest in 111 West 57th Street, Ambase Corp. refused the capital infusion.