As New York City’s condominium market navigates a slump, things are looking rosier in Greenwich.

In the fourth quarter, condo sales in the Connecticut town surged 23 percent from a year earlier, according to Douglas Elliman’s latest market report. At the same time, the median sales price dipped 3.1 percent to $746,250. Single-family sales slid 2.2 percent, with the median sales price falling 16.7 percent.

“The shift in price indicators is partly due to the new tax law, which affects the higher end more,” said Scott Elwell, Elliman’s senior executive manager of Westchester and New England. “I’m still optimistic on Greenwich, as we’re seeing more interest from Westchester because of taxes.”

The condo sales uptick stems, in part, from buyers less interested in renovations and more eager to buy homes that are move-in ready, Elwell added. The “lifestyle aspect” of new construction condos has helped the sector.

(Credit: Douglas Elliman)

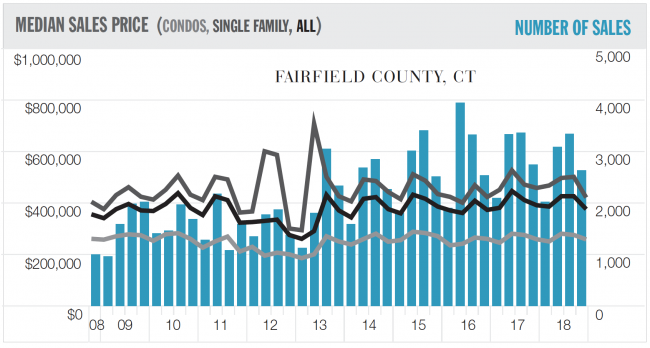

Meanwhile, in Fairfield County overall, sales fell 4 percent with the median price sliding 3.8 percent to $375,000. That marked the fourth straight quarter of year-over-year declines in the market, as inventory has climbed after 10 quarters of declines. Broadly, there has been a shift toward smaller properties, said Jonathan Miller, author of the report and CEO of appraisal firm Miller Samuel.

In Greenwich’s single-family market, the average size fell 7.4 percent, with the average price per square foot declining 12.3 percent to $555. In Fairfield’s luxury market, the average price per square foot slid 10 percent versus a year earlier to $524.

“There’s been a shift in the mix away from the top echelon of the housing market,” Miller said. “Volatility in the financial markets seems to be more impactful on the upper end.”