Another sizeable New York City rent-stabilized apartment portfolio traded before the end of 2019.

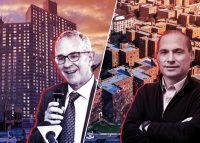

An entity tied to Yechiel Newhouse paid about $118 million for a 407-unit portfolio of 31 mostly rent-stabilized buildings in Harlem in a deal that closed on Dec. 20, according to public records. The portfolio also includes retail. The seller was Ben and Jon Soleimani’s ABJ Property, which assembled the Harlem buildings in pieces over the years, records show. The firm made several multifamily purchases in Manhattan and the Bronx in recent years.

New York Community Bank provided Newhouse with $90 million in financing for the purchase.

The broker on the sale, Victor Sozio of Ariel Property Advisors, declined to comment on the deal. The buyer and seller were not immediately available to comment. New York Community Bank didn’t immediately respond to a request for comment.

More than 85 percent of the residential units are rent stabilized, according to tax filings. The portfolio includes nine mostly contiguous buildings on Adam Clayton Powell Jr. Boulevard and four buildings between 120th and 122nd streets on Manhattan Avenue.

The trade is just the second sizeable rent-stabilized portfolio to trade since the New York State legislature made significant changes to the rent stabilization law. Doug Eisenberg’s A&E Real Estate Holdings bought a sprawling Rego Park portfolio for $129.5 million, a 38 percent discount from the portfolio’s original ask.

The drastic changes limited the increases to rents that may be passed on to tenants for apartment and building-wide improvements, and eliminated nearly all pathways to bring rent-stabilized apartments to market rate.

The value of multifamily buildings sold in the third quarter of last year totaled $1.1 billion — about half of what it was in the same period last year.

Read more