Who isn’t longing for a meal at a favorite eatery?

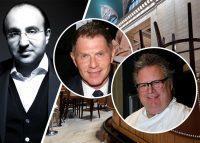

Michael Stillman of Quality Branded — the restaurant group behind Quality Meats, Park Avenue and Smith & Wollensky New York — is craving a meal at classic Upper East Side Italian restaurant Elio’s.

Bill Bonbrest, COO of TAO Group, is missing the food at any of the hospitality company’s many restaurant brands, be it Beauty & Essex, LAVO or TAO.

Post-Covid, though, the experience could be a bit different.

The restaurateurs joined hospitality consultant Steven Kamali and The Real Deal’s James Kleimann on Monday to discuss how food and beverage concepts are being altered by the pandemic and what the future of dining services could look like.

Potential changes include strictly timed seatings, meal kits for some TAO Group signature dishes and partnerships between restaurant operators and landlords.

Stillman said he’s mulling the idea of reservations that also have an end time, so restaurants can more accurately gauge the amount of business they will have each night.

Kamali predicted an increase in real estate owners entering into management contracts or joint venture agreements with restaurants, as opposed to offering a lease.

“Most landlords are going to find that participating in these ventures with these food and beverage operations is the best opportunity for success,” he explained. The consultant later noted that most restaurants do not have access to capital or loan facilities alone. That’s where, he hopes, the real estate community can lend a hand.

“The last thing we want to see is these landlords having to replace all of these tenants at some point in the near future,” he said. “Unfortunately, the outlook is rather grim.”

Kamali, who founded The Restaurant Network to help restaurant owners negotiate rent with landlords, said his firm surveyed 2,000 eateries this month and found 20 percent had shuttered for good.

He predicted the number of establishments to fold could rise as high as 50 percent, particularly if customers aren’t ready to patronize restaurants once they can reopen.

Read more

Bonbrest and Stillman agreed that whenever dining can resume, it will be with a reduced capacity, which makes fully reopening economically risky.

“The scary part for us is, to an extent, whoever opens up first for à la carte dining at least is going to lose,” said Bonbrest.

With prospects for normal service so uncertain, Bonbrest said TAO Group is beginning to explore takeout and delivery service and preparing meal kits that would come from one centralized kitchen.

The company shut all its restaurants March 23, laying off more than 4,000 employees. Bonbrest said the reception from landlords in terms of rent relief has been “a mixed bag” and said the pandemic has meant many owners are now “getting a look at the reality of what our business is really like.”

Stillman said he sees property owners and managers playing a key role in the survival of restaurants — if they still believe in “the power of restaurants.”

“We’re focused a lot on trying to make deals that make sense for both parties over the long term if they believe that restaurants can still be the new anchor tenant in the new world — and I believe they can be,” he said.

Stillman noted that he expects the pandemic’s fallout will mean years, not months, of pain for restaurant operators. However, he said, he is still betting on restaurants over retail. He pointed to his father, TGI Fridays founder Alan Stillman, as an example of why dining out will bounce back.

“My father finally figured out how to use Amazon. How many other guys his age can suddenly use Amazon?” said Stillman, whose father is in his 80s. “But he’s still going to go to a restaurant in the long run, I believe.”

Write to Erin Hudson at ekh@therealdeal.com