As coronavirus battered the residential market, Toll Brothers said its second-quarter profits dropped nearly 42 percent from a year ago, to $75.7 million.

The luxury home builder reported that signed contracts dipped 22 percent as buyers complied with stay-home orders. Home sale revenue was $1.52 billion, down 11 percent from $1.71 billion in the second quarter of 2019.

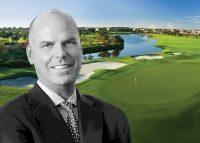

The results were a reflection of “complex and challenging” circumstances sparked by the pandemic, CEO Douglas Yearley said during an earnings call. “Our second quarter was bifurcated by the effect of Covid-19,” he added.

Read more

For the six weeks ended March 13, Toll’s net signed contracts were up 43 percent year-over-year. That activity ground to a halt when sales centers were shut.

From March 16 to April 30, Toll said its net contracts plummeted 64 percent. In the most affected markets, including New York City, Seattle and California, net contracts declined 79 percent.

In New York City, properties still can’t be shown. “You can’t get by the doorman,” Yearley said.

Elsewhere, he said, buyers began to reappear in May. Deposits rose 13 percent over the past three weeks, compared to the prior year. Last week’s contracts were the most since 2005. And the CEO says homes have taken on more importance to people since the pandemic hit.

“I feel strongly that people are nesting, and this is not short-term,” Yearley said. “There is no place like home. Home is your sanctuary today.”

Toll finished the quarter with a backlog of 6,428 homes representing $5.5 billion in pending sales. Cancellations have remained low, around 3.1 percent, compared to 3 percent in the first quarter.

Toll said its luxury business was flat in the second quarter and business from empty-nesters was down, as expected. “That client was more inclined to shelter and be careful,” Yearley said.

Toll ended the quarter with $2 billion in liquidity as it pulled back on land acquisitions and enacted sweeping cuts, including furloughs. Toll said those measures generated $50 million in savings.

Earlier this year Toll withdrew its full-year guidance as the coronavirus created vast uncertainty. Many companies did the same, including competitor Lennar Corp. The Miami-based builder reported strong first-quarter earnings in March, when it said net earnings were $398.5 million, up from $239.9 million. But sales largely reflected the pre-pandemic environment.

Last month, Toll sold the Parkland Golf & Country Club in South Florida for $15 million.