A Midtown building that has found buyers for only seven of 68 units since sales launched in 2017 has received a cash lifeline.

Singapore’s United Overseas Bank has issued the East 59th Street tower a $204 million condo inventory loan for the 61 unsold residences, an 18,000-square-foot commercial unit and 981 Third Avenue, a 9,500-square-foot retail property one door down. The loan was first reported by PincusCo Media.

Read more

The refinancing comes on the heels of Manhattan’s already sluggish condo market freezing up as Covid-19 infections prevented in-person showings for nearly three months. Some condo developers are scrambling to line up fresh financing in the face of slow sales, while others are mulling low-ball offers from bulk buyers.

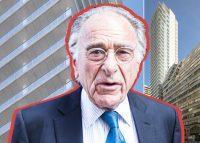

The Midtown East tower, at 200 East 59th Street, is owned by private fund manager Alpha Investment Partners, the real estate investment arm of Singaporean asset manager Keppel Capital. Developer Harry Macklowe was a partner in the project before Alpha bought him out last year.

Alpha has since brought in Centurion Real Estate Partners as a replacement sponsor to complete the project, which has a projected sellout of $331 million. Centurion slashed prices by about 18 percent and changed the marketing materials.

United Overseas Bank has been involved in the project since 2014 when it provided Alpha and Macklowe a $65 million acquisition loan. Two years later, it provided the partners with a $116.6 million construction loan.

The new loan replaces $168 million in outstanding debt and includes an additional $36 million. The transaction closed in mid-June and its terms are unknown.

United Overseas Bank, Alpha and Centurion declined to comment.

Write to Erin Hudson at ekh@therealdeal.com