CoStar adding $1.25B to war chest

CoStar adding $1.25B to war chest

Trending

CoStar closes in on CoreLogic

Data giant previously offered $77 to $83 per share

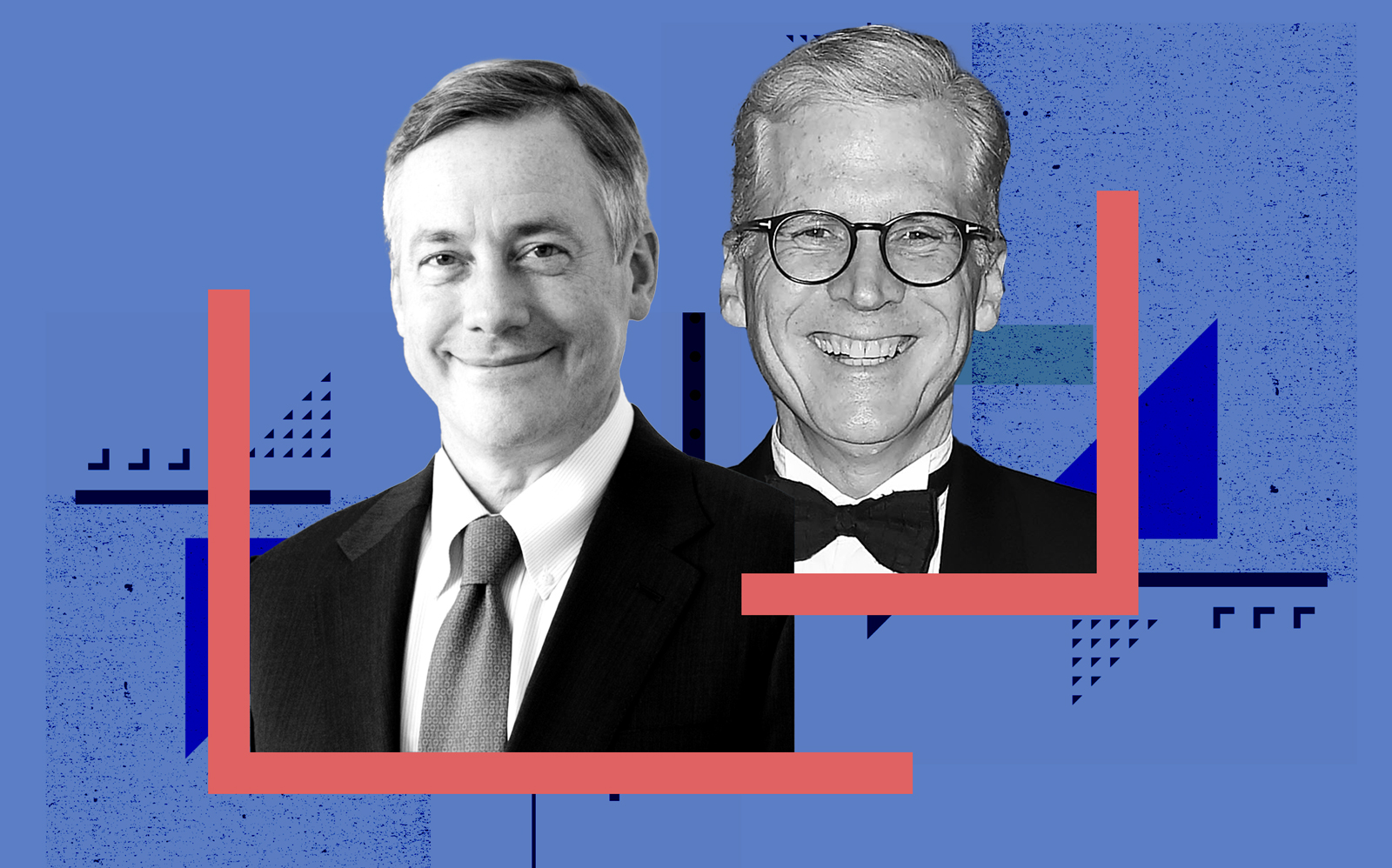

CoStar Group may be nearing its next acquisition.

The data giant and a private group, led by Warburg Pincus, have emerged as the final two bidders for CoreLogic, a data provider for the real estate and mortgage industries, reported Bloomberg News.

The bids are not known, but CoreLogic is said to be evaluating offers and will make a decision in the coming weeks. Ultimately, CoreLogic may opt to remain independent.

For CoStar — which has spent billions of dollars acquiring companies over the past few years — the deal would be its biggest takeover yet, Bloomberg said. The company had $3.8 billion in cash as of Sept. 30, 2020, regulatory filings show.

In November, it paid $250 million to buy Homesnap, a listing portal. A month later, CoStar’s deal to buy RentPath for $585 million was called off after federal antitrust regulators sued to block the deal.

Read more

CoStar adding $1.25B to war chest

CoStar adding $1.25B to war chest

EXCLUSIVE: CoStar’s Andy Florance on buying Ten-X, the future of office buildings and why brokers don’t need discounts

EXCLUSIVE: CoStar’s Andy Florance on buying Ten-X, the future of office buildings and why brokers don’t need discounts

CoreLogic, which is based in Irvine, Calif., has been in the crosshairs of potential acquirers for months. In June, activist investors Cannae Holdings Inc. and Senator Investment Group offered to buy the company for $66 per share. But they backed out of the deal when CoreLogic said it got an offer as high as $80 per share. In November, CoreLogic launched a strategic review of its options after Cannae and Senator won three seats on its board.

Its stock closed at $76.79 per share on Thursday, giving it a $5.9 billion market cap.

CoStar’s interest in CoreLogic has been known for several months. In October, it reportedly offered $77 to $83 per share, according to Bloomberg. But talks stalled after CoStar refused terms of CoreLogic’s non-disclosure agreement.

[Bloomberg] — E.B. Solomont