DivcoWest struck a deal to buy a Hudson Square building in what could be one of the first big office trades of the new year.

The San Francisco-based real estate investment firm has an exclusive agreement to buy Jamestown Properties’ 325 Hudson Street, sources told The Real Deal. Pricing for the 10-story, 225,000-square-foot building is north of $150 million, according to one source.

Representatives for DivcoWest and Jamestown did not respond to requests for comment. CBRE, which sold the building to Jamestown nine years ago, negotiated the deal.

Read more

Depending on the timing, 325 Hudson could end up being one of the first big investment sales of the year, after a spurt of big-ticket deals closed right before the end of 2020.

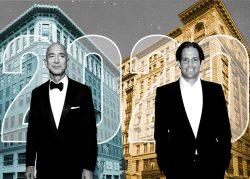

Jamestown bought the property in 2012 for $110 million in partnership with Philadelphia-based developer Amerimar Enterprises and the telecoms entrepreneur Hunter Newby. The former industrial building sits on top of the Transatlantic cables and high-speed fiber corridors that run through Lower Manhattan, making it popular with telecommunications and tech tenants.

In the 1990s, it was reportedly one of the first office buildings to be marketed as a dedicated telecoms center for commercial tenants.

DivcoWest, meanwhile, closed its sixth value-add real estate private equity fund in October with $2.25 billion in capital commitments. The company, headed by founder and CEO Stuart Shiff, paid $310 million in 2019 to buy the 39-story 540 Madison Avenue office building from Boston Properties.