The office market in Manhattan finished out a bleak year with an even bleaker quarter.

Manhattan’s office availability in the fourth quarter hit a record high of 14.3 percent. That’s 16.3 percent higher than it was in the third quarter, and up 43 percent compared to a year ago, according to Colliers International’s latest market report.

A big chunk of that — 24.2 percent — was sublet inventory, which expanded by 6.45 million square feet in the past year.

Overall, the pandemic left a large scar in Manhattan’s office market in 2020, reducing the annual leasing volume to 18.9 million square feet, down by 56 percent from a year ago.

As companies deal with both a devastating economic downturn and grave uncertainty about their future office needs, leasing activity has dramatically declined. In the fourth quarter, only 4.2 million square feet was leased — down by a whopping 68.4 percent compared to the same period last year.

Read more

The average asking rent in the fourth quarter was $74.39 per square foot, a decrease of 3.5 percent compared to the third quarter, and down 5.6 percent from a year ago.

The severe impact from the pandemic was visible in all market indicators, said Franklin Wallach, Colliers’ senior managing director for New York research. But “value-seeking tenants” found some opportunities, he said.

Major leases signed during the fourth quarter included NYU Langone’s 633,000-square-foot renewal at Vornado Realty Trust’s One Park Avenue; Justworks’ 270,000-square-foot renewal at 55 Water Street; the City of New York’s 157,000-square-foot renewal at AmTrust’s 250 Broadway; the Travelers’ 133,000-square-foot renewal at SL Green’s 485 Lexington Avenue; and Apple’s 117,000-square-foot expansion at Vornado’s Penn 11.

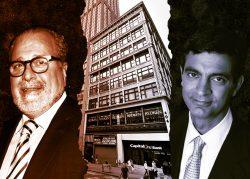

The office investment sales sector was also affected by the pandemic, with a fewer number of deals made in the fourth quarter compared to a year ago. But the top deal — SL Green and Kaufman Organization’s sale of 410 Tenth Avenue for $952.8 million to 601W Companies — made a big splash. Total sales in the fourth quarter was $1.15 billion, down by 62 percent compared to a year ago.

Peter Nicoletti, Colliers’ managing director and head of New York City capital markets, said that in 2021, “we anticipate more activity, especially around well-leased assets and those that are significantly impared.”