The vultures will have to keep circling Manhattan’s office buildings.

Ladder Capital saved a pair of Midtown office buildings from possible foreclosure last week, when it provided R&B Realty Group just under $51 million to pay off its loans, the landlord told The Real Deal.

R&B’s buildings at 28 West 36th Street and 32 West 39th Street were the subject of a lawsuit in February, when the landlord filed a case to stop mortgage investor Maverick Real Estate Partners from foreclosing on them.

R&B sought to refinance its debt with a new lender after telling a New York court that Maverick was “charging a default interest of 24 percent on each of the loans, and seems intent to…acquire the buildings on the cheap.”

Read more

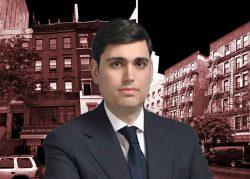

“We have owned the buildings for nearly two decades, and built a healthy equity on the properties,” said R&B CEO Aron Rosenberg, who added that the firm secured the financing in two weeks.

Maverick did not respond to a request for comment. The real estate investment firm has raised hundreds of millions of dollars to purchase distressed real estate assets.

Ladder Capital’s $50.88 million loan closed Friday, March 5, according to Rosenberg, who said his company was “very fortunate” to have found Ladder.

Signature Bank had sold the debt on the two Midtown buildings to Maverick after declaring the loans to be in default.

R&B claimed its line of credit with Signature remained open and not fully tapped, making the declaration of default invalid because, according to R&B, it could still service the loans.

Those concerns are now passé, according to Rosenberg, who said the refinancing from Ladder brings the office buildings into full financial compliance.