Storage Wars: HFZ Capital battles to save tenants’ stuff from auction

Storage Wars: HFZ Capital battles to save tenants’ stuff from auction

Trending

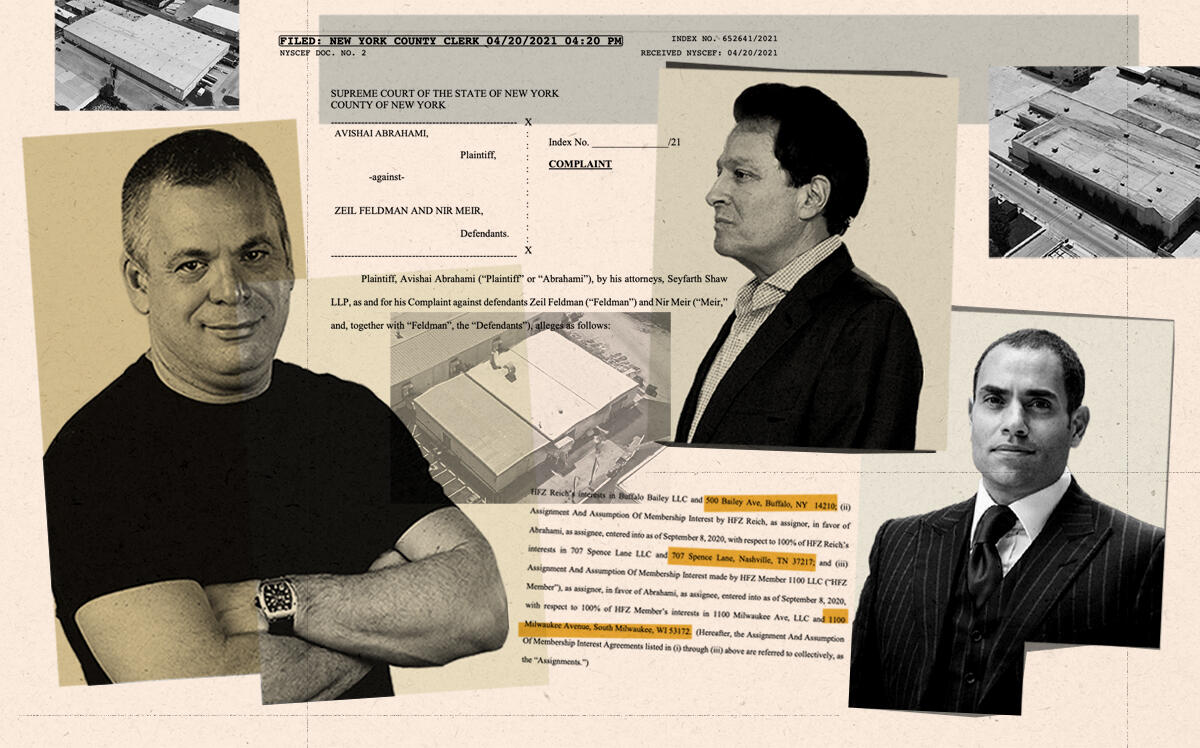

Ziel Feldman, Nir Meir accused of fraud over $30M loan

Wix.com CEO alleges double-dealing in lawsuit

The legal troubles continue for HFZ Capital Group’s Ziel Feldman and its former principal Nir Meir: Another lender has sued the developer and his one time colleague, accusing the pair of fraud and breach of contract.

Israeli tech magnate Avishai Abrahami, who founded Wix.com, filed a complaint Tuesday in New York State Supreme Court, alleging that in September 2020, Feldman and Meir pledged HFZ’s equity interest in three buildings as collateral for a $30 million loan from him — only to find out later that the same properties had been used as collateral for a different lender.

HFZ pledged the equity interest in those buildings — located in New York, Tennessee and Wisconsin — to both Abrahami and Chicago-based Monroe Capital, according to the complaint. HFZ obtained its interest in the buildings in a partnership with Westchester, New York-based industrial investment firm Reich Brothers.

Read more

Storage Wars: HFZ Capital battles to save tenants’ stuff from auction

Storage Wars: HFZ Capital battles to save tenants’ stuff from auction

Judge rules against Nir Meir in HFZ’s $19M default case

Judge rules against Nir Meir in HFZ’s $19M default case

Following UCC foreclosure proceedings on at least part of HFZ’s industrial portfolio, Monroe purchased HFZ’s interest in the buildings at an auction in December 2020 — interests that Abrahami says belonged to him.

In the complaint, Abahrami’s lawyers accuse Feldman and Meir of “fraud and intentional misrepresentation” in connection with the loan. Abrahami wants the court to enforce a so-called “good guy guarantee,” signed in September 2020 by Feldman and Meir, making them personally liable for the loan. Good guy guarantees, which make individuals personally liable for debt held by a business, are meant to dissuade guarantors from reckless financial dealings.

Abrahami is asking the court to make Feldman and Meir personally pay back the loan and accrued interest — a total of $33.6 million — in accordance with the original agreement.

Attorneys representing Abrahami, Feldman and Meir did not immediately respond to requests for comment.

In December, Feldman took over day-to-day management of HFZ from Meir. A spokesperson for Meir said at the time he remained a “vested partner” in the firm, which he co-founded with Feldman in 2005. But in a lawsuit filed earlier this month, the Feldman accused Meir of stealing $15 million through fraudulent credit card reimbursements and wire transfers. The lawsuit also noted that Meir was terminated when the extent of his “malfeasance for his personal benefit” came to light.

And a New York judge recently ruled that Israeli auto industry magnate and art collector Yoav Harlap could go after Meir for $18.5 million in loan debts, with Feldman saying his signature on the loan was forged and that Meir signed without proper authority. In March, CIM Group alleged that HFZ still owed it $48 million after the lender took control of four Manhattan condo conversion projects.