UPDATED April 20, 2020, 11:30 a.m.: It must have seemed like a sure thing: a luxury condominium development on the Upper East Side.

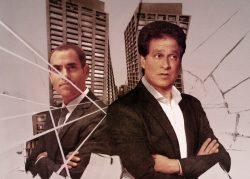

To assemble the properties needed for the project, HFZ Capital borrowed $20.5 million from an Israeli investor. The developer’s top brass, Ziel Feldman and Nir Meir, provided personal guarantees on the loan in case something went wrong.

It did.

The development never got off the ground and in 2019, HFZ defaulted on its debt. But now the lender’s attempts to collect on the guarantees has become a drama unto itself.

Read more

By the time the lender sued HFZ, Feldman, and Meir in November, the developer was already in financial ruin. A month later, Meir left the company and HFZ was facing foreclosures, liens and allegations of wrongdoing from subcontractors.

Making lender YH Lex Estates even more nervous, Feldman and Meir were selling off their personal residences — assets that could be used to satisfy the guarantees on HFZ’s loans. The Southampton estate Meir was unloading, built in 2017, had been appraised at about $40 million.

YH Lex Estates — which is a business of Israeli auto industry magnate and art collector Yoav Harlap — tried but failed to stop the sale, which closed in early April. But last week, just when it seemed the lender’s streak of bad luck with HFZ might never end, a New York judge ruled that it could go after Meir for $18.5 million.

About $10 million of that could come from the sale of the Southampton home, a 6,600-square-foot mansion at 40 Meadow Lane, after its creditors and mortgage holders take their cut. Among them is hedge fund manager Harsh Padia, an HFZ creditor who holds an $8 million second mortgage.

Meir is appealing the judge’s decision. His lawyers argue that before the lender can go after Meir, the court first has to rule on HFZ’s argument that it is not obligated to pay because of problems with the loan documents.

“The court acted prematurely in deciding the case against Meir before it resolved the issues raised by HFZ,” said Larry Hutcher, co-founder of New York-based law firm Davidoff, Hutcher and Citron. “Meir has a complete defense to this action and we are confident that the appellate (court) will agree with us.”

The lender still hopes to recover the rest of the unpaid loan from HFZ and Feldman, who — in another twist — claim their loan guarantees are invalid, but for different reasons. The firm argues that Meir illegally signed loan documents on its behalf, while Feldman claims his signatures on the loan guarantees were forged. He plans to bring in a handwriting expert to court in June.

The Upper East Side project is far from Feldman’s only concern. He and his wife, Helene, are personally on the hook for a number of loans tied to HFZ’s projects, some much larger than the Upper East Side venture. HFZ’s biggest is the XI, a stalled Bjarke Ingels–designed condo and hotel spanning a full city block along the High Line.

While YH Lex Estates sues HFZ, Feldman and Meir, the developer is suing Meir, alleging that he used the firm as his “personal piggy bank” to the tune of $15 million in fraudulent credit card reimbursements and wire transfers.

Meir’s lawyers deny these allegations. “They’re seeking to blame him as a scapegoat and we won’t tolerate it,” said Hutcher. He said Meir has paid more than $10 million in recent months to satisfy HFZ creditors.

Harlap and his brother, Dr. Shmuel Harlap, own the Colmobile import franchise for Mercedes, Mitsubishi and Hyundai, and he also invests in real estate, according to Haaretz. In 2015 he bought a co-op unit at 860 Fifth Avenue for $7.6 million, property records show.

Attorneys for HFZ and Feldman did not return a request for comment. YH Lex Estates attorney Mark Hatch-Miller of Susman Godfrey declined to comment.

This article has been revised to add information about Yoav Harlap.