Trending

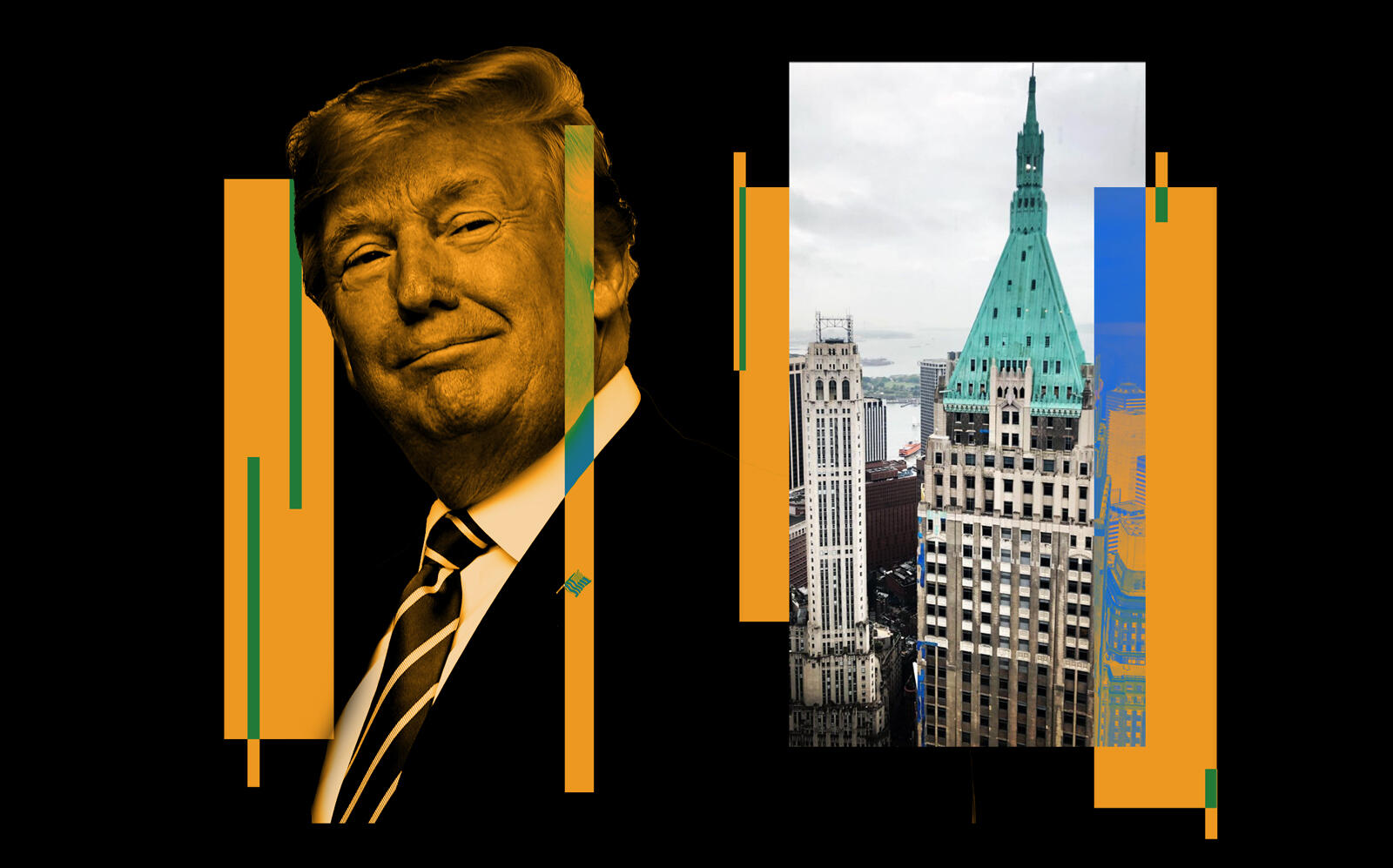

40 Wall’s valuation chop means tax savings for Trump Org

Office building’s value fell 29% to $130M

The market values of office towers have plummeted during the pandemic, declines that could equal discounts for Donald Trump.

The former president’s family firm could pay nearly $1.7 million less on property taxes for the office tower at 40 Wall Street after the building’s value slumped 29 percent to about $130 million for the coming fiscal year, Bloomberg News reported.

The break would offer the Trump Organization some reprieve from the revenue declines that rippled across the firm’s portfolio this year.

The Wall Street building’s revenue fell $27.7 million from January through September 2020, or around $37 million for the year in total, Bloomberg found in an analysis of loan documents. That’s a 11 percent drop year-over-year.

The tumultuous end to the Trump presidency also left a mark. Tenants have considered leaving the property, while broker Cushman & Wakefield has distanced itself from the developer after the Jan. 6 Capitol riots.

The building has also been the target of a state probe into whether Trump falsely reported asset values to obtain tax benefits. The investigation stemmed from claims last year by Trump’s former personal lawyer Michael Cohen.

Trump isn’t the only developer set to benefit from tax cuts. Building owners across the city should receive similar breaks, said Martha Stark, professor at New York University’s Robert F. Wagner Graduate School of Public Service. Manhattan office towers saw a median 25 percent drop in market value, according to a May report from the city’s Independent Budget Office, cited by Bloomberg.

The state will release final assessments for the upcoming tax year later this month. Figures could show greater reductions than those listed in January’s initial assessments.

[Bloomberg News] — Suzannah Cavanaugh