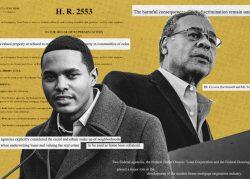

An investigation has found that lenders were more likely to deny home loans to borrowers of color because of a bias hidden in mortgage algorithms.

The study by the Markup, released in conjunction with the Associated Press, found that lenders were more likely to deny borrowers of color than white borrowers with similar financial backgrounds. The investigation looked at over 2 million conventional mortgage applications from 2019, holding 17 different factors even to achieve an apples-to-apples comparison.

The statistical analysis found that lenders were 80 percent more likely to reject Black applicants than white ones, 70 percent more likely to reject Native Americans, 50 percent more likely to reject Asian/Pacific Islanders and 40 percent more likely to reject Latinos.

The disparities varied by region, too. In Chicago, for instance, lenders were 150 percent more likely to reject Black applicants than similar white ones.

Read more

The American Bankers Association and Mortgage Bankers Association noted that the analysis did not consider applicants’ “Classic FICO” scores, which are not available for research because the industry has lobbied to keep them from public view.

Fannie Mae and Freddie Mac buy about half of the mortgage loans in the U.S., but only those whose applicants have a Classic FICO score of at least 620. For a variety of reasons, that score is easier for white applicants to achieve. That likely plays a role in rejection rates because mortgage lenders avoid issuing conventional loans that they cannot sell to Fannie or Freddie.

Still, the absence of credit scores does not explain the vast discrepancies found in the data.

Freddie Mac and Fannie Mae also use algorithms for underwriting, which may have inherent bias. Fannie Mae is set to make a major change to its underwriting software next month that will factor in borrowers’ rent payment history when looking at applications, a factor not considered in credit scores.

[AP] — Holden Walter-Warner