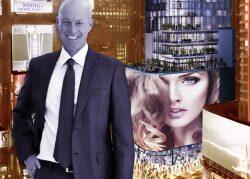

Maefield Development’s Times Square Edition will soon change hands after a New York State court entered a judgment of foreclosure and sale for the luxury hotel.

The judgment will put the 42-story property at 20 Times Square on the auction block, Bloomberg reports, likely ending a long-running dispute between Maefield and the hotel’s lenders, led by Natixis.

The 452-room hotel at 701 Seventh Avenue opened to great fanfare in February 2019 and the property was once valued as high as $2.4 billion.

But the hotel struggled to bring in retail tenants and generate a positive cash flow before lenders sued in 2019, Bloomberg reports. As the pandemic ravaged the hospitality industry, the hotel was shuttered in March 2020.

In March, a judge granted the hotel’s lenders the right to foreclose on the property, owned by Mark Siffin’s development company. The property had faced foreclosure since December 2019, when the lenders of a $650 million loan sued the owner, charging there were “numerous undischarged mechanics’ liens recorded against the property.”

Read more

Last month, Bloomberg reported a $150 million loan for the land beneath the hotel was being marketed for sale. The junior loan is part of a $900 million debt linked to the ground.

The auction and sale of the property may not be the end of Maefield’s problems. Construction company CNY, the construction manager of the property, in July filed a petition in New York Supreme Court against an entity of the Witkoff Group, an original partner of the project before it was bought out by Maefield in 2018. CNY is attempting to recover $21.6 million for unpaid work at the building.

[Bloomberg] — Holden Walter-Warner