A new edition of a noteworthy Midtown hotel could be on the way after new owners last week won control of the luxury lodging.

A lenders group led by Natixis will take over the Times Square Edition Hotel at 20 Times Square from Mark Siffrin’s Maefield Development, the New York Post reported. No bids at a Jan. 26 public foreclosure auction topped the group’s offer, which hasn’t been revealed. The title is expected to be transferred in the coming weeks.

Maefield appeared destined to lose the hotel when a New York state court entered a judgment of foreclosure and sale of the property in November. The hotel’s lenders and Maefield have been in a long-running dispute over the 42-story property.

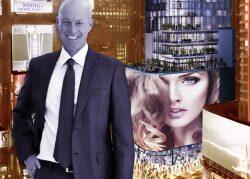

The 452-room hotel at 701 Seventh Avenue opened to great fanfare in February 2019 and the property was once valued as high as $2.4 billion.

But the hotel struggled to nab retail tenants and generate positive cash flow and lenders wound up suing in 2019. The hotel was closed in March 2020 as the pandemic shuttered the hospitality industry. It reopened last June.

Read more

In March, the hotel’s lenders were granted the right to foreclose on the property. The property had been facing foreclosure since December 2019, when the lenders behind a $650 million loan sued the owner for “numerous undischarged mechanics’ liens recorded against the property.”

A $150 million loan for the land beneath the hotel was being marketed for sale, Bloomberg previously reported. The junior loan was part of a $900 million debt linked to the ground.

The details around the hotel’s future under its new ownership are cloudy. According to the Post, the Marriott-owned Edition brand has a strong management contract that can’t be affected by the ownership change, meaning it is likely to stay in place.

Changes are coming, though. The Post reported earlier this month the lenders called upon SL Green to service the building’s loan and consult. The role for Marc Holliday’s company could ultimately lead to SL Green becoming the property’s asset manager, but the Post reported the landlord is not thought to be interested in buying the property.

[NYP] — Holden Walter-Warner