Americans who can no longer afford houses might now be priced out of condos, too.

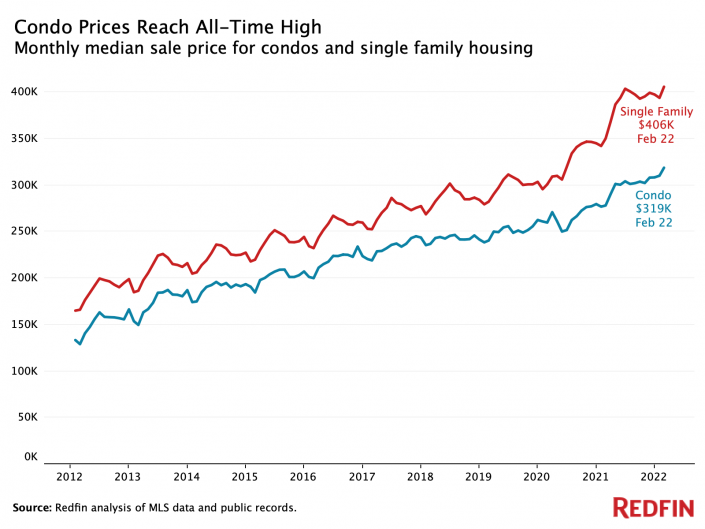

The typical U.S. condominium unit sold for a record $319,000 last month, or 14.6 percent more than a year ago, according to a new report from Redfin. The increase was caused in part by a shortage of listings for houses — whose median price is up to $406,000 — causing home shoppers to look at condos instead.

The condo market is still not as cutthroat as that for detached homes. Nearly 75 percent of detached-home sales in February involved bidding wars, compared with just under 65 percent of condo sales. But condos have kept heating up as more buyers are priced out of the detached-home market.

“The condo market has bounced back,” said Chance Glover, a Redfin manager in Boston. “People are no longer afraid to live downtown, close to the crowds — and they often prefer it, because they’re close to the office and all the amenities of the city. Rising prices are pushing single-family homes out of reach for a lot of buyers, so condos are affordable in comparison.”

Read more

Listings remain as rare as they have been in ages. Listings for condos fell 28 percent over the past year, twice as much as for single-family homes, and 40 percent of condos are selling over their asking price. (It is a dramatic shift from the beginning of the pandemic, when remote work and other factors caused sales to drop 48 percent.)

The median condo price in Miami rose to $383,000, an increase of nearly 33 percent year-over-year. Inventory fell by roughly 30 percent over the same period. Condo sales and prices rose in Broward and Palm Beach counties.

In New York, the median condo price rose by 11 percent to $599,000. A recent pipeline report from Corcoran projected that condo development would lag in the coming years as a result of the pandemic hampering construction. Experts say that could keep the market tight for a while yet.