KABR scoops up luxury building in Bayonne for $50M

KABR scoops up luxury building in Bayonne for $50M

Trending

NJ-based real estate firm continues push into Stamford

KABR teaming up with Greystone on $41M portfolio purchase

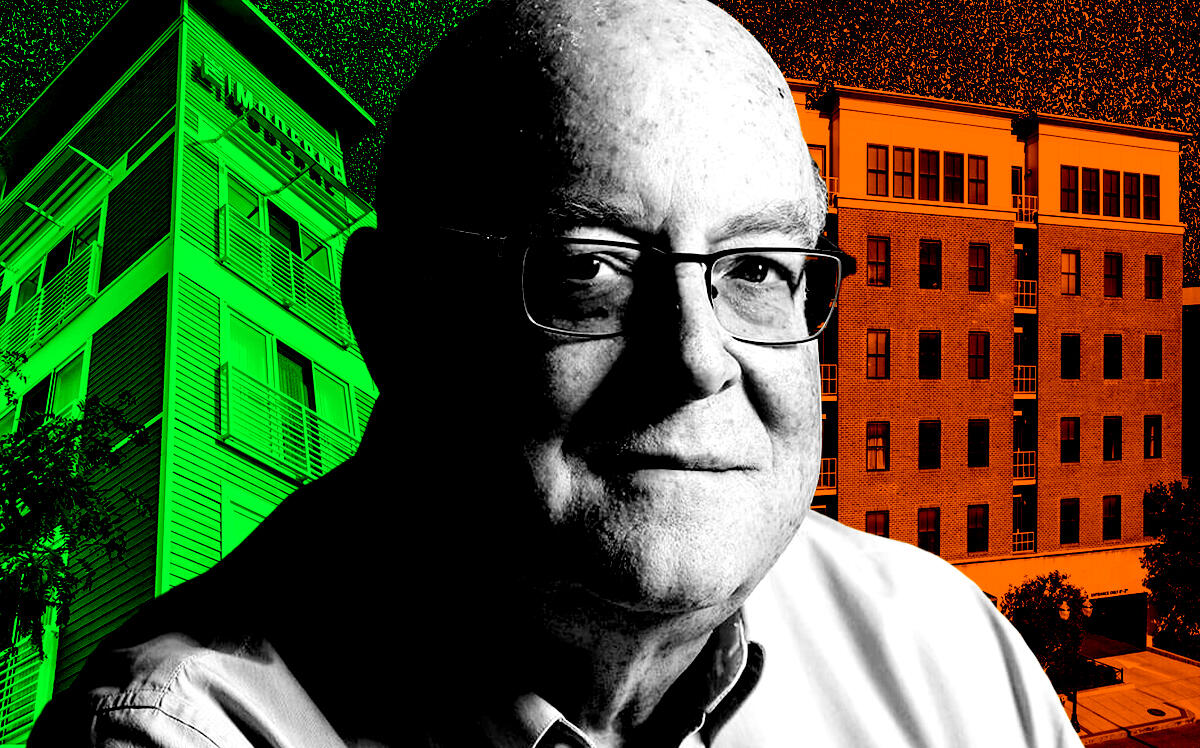

UPDATED March 31, 2022, 7:56 p.m.: New Jersey-based KABR Group is making further inroads in another tri-state area market with its second and third multifamily purchases in Connecticut.

The private equity real estate firm, in a joint venture with a joint family office, acquired two multifamily communities in Stamford for $41.3 million. The portfolio totals 116 units at 163 Franklin Street and 750 Summer Street.

The buildings were formerly known as The Moderne and The Verano, respectively. Under KABR’s ownership, they will be rebranded and receive upgraded common areas and amenities.

The seller was a partnership between Navarino Capital Management and Aetna Real Estate Investments. It was represented by a JLL team including Steve Simonelli and Jose Cruz. Greystone arranged the financing.

Read more

KABR scoops up luxury building in Bayonne for $50M

KABR scoops up luxury building in Bayonne for $50M

Madison Realty Capital sells $73M Queens industrial site

Madison Realty Capital sells $73M Queens industrial site

Office landlord Monday Properties makes $131M multifamily play in CT

Office landlord Monday Properties makes $131M multifamily play in CT

In a prepared statement, KABR CEO and chairman Ken Pasternak noted the multifamily real estate fits into the firm’s strategy of buying assets in Fairfield County “transit cities.” The properties are approximately one mile from the city’s train station and less than a mile from Interstate 95 and Route 1.

The property at 163 Franklin Street has 58 units, according to Apartments.com, with average monthly rent of $2,800. Features include a 24-hour fitness center, a cafe, a rooftop with gas grills and a TV, and a lounge.

Similarly, the property at 750 Summer Street also includes 58 units, according to Apartments.com, that rent for an average of $2,850. The amenities largely match those at 163 Franklin Street, as does the layout for units, which range from one- to three-bedroom apartments.

KABR’s previous Stamford purchase was of 66 Summer Street, which it acquired with Ceruzzi Properties. The 209-unit luxury building was completed in 2016 and includes 7,500 square feet of retail space.

The Stamford portfolio purchase marks KABR’s second multifamily deal in as many weeks. Earlier in March, KABR picked up a mid-rise luxury apartment building in Bayonne, New Jersey, for $49.6 million from joint sellers Ingerman Group and Verde Capital.

Correction: KABR acquired the properties in a joint venture with a private family office, not with Greystone. Greystone arranged the financing.