Gary Keller is the closest you can get to an elder statesman of residential brokerage. The founder of Keller Williams has guided his firm through four decades of market fluctuations and played a Rooseveltian role in the industry when things have gotten tough, optimistic even in the toughest of times.

So when Keller says that today’s outlook reminds him of the Great Recession, the industry pays attention.

“The second year of the Great Recession, we had the largest drop in one year in recorded history,” Keller said last month at an Inman virtual conference, adding that “1.5 million transactions were taken off the book.”

A combination of rising mortgage rates and home prices that are out of reach for most Americans will mean this year will see deals decline by about 1.3 million, he predicted.

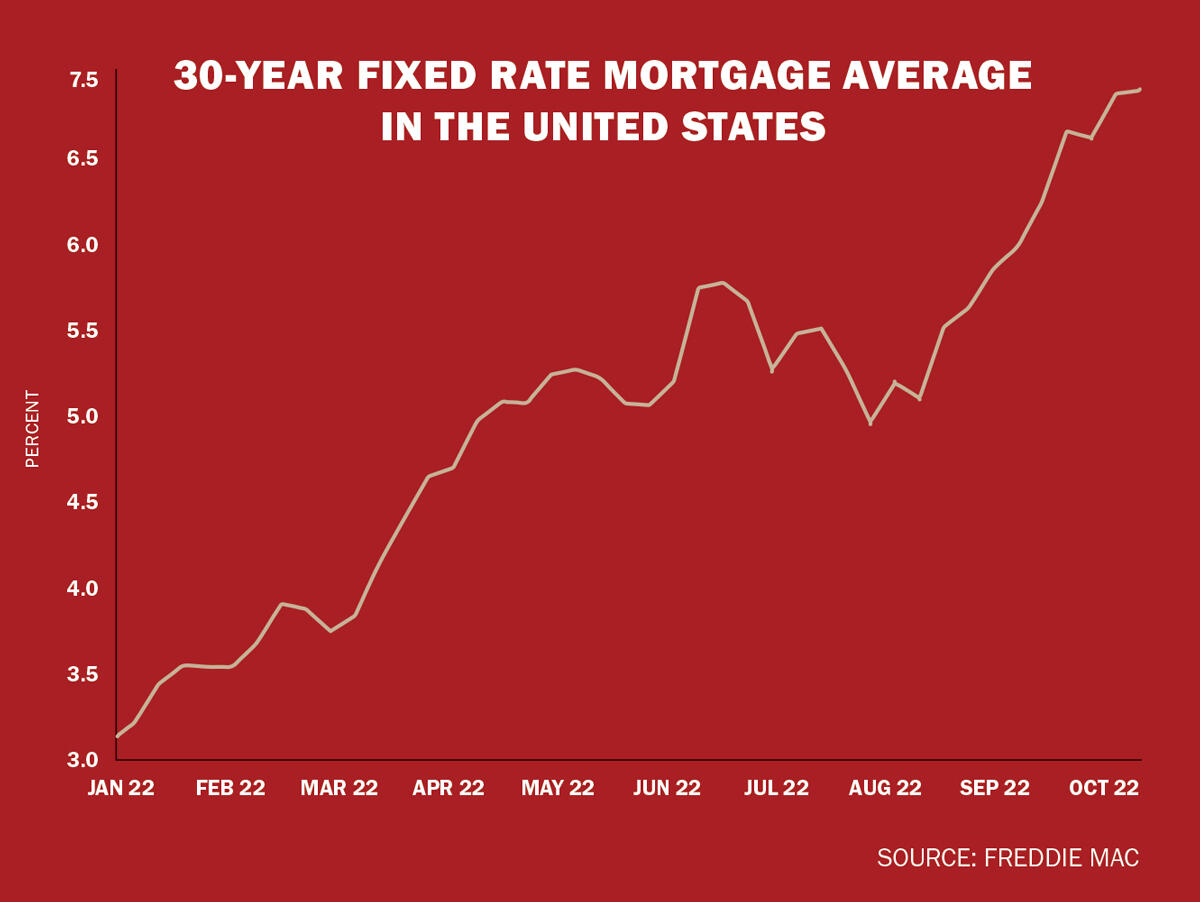

After a bonanza period of record transaction volume, prices and profit-making, the residential industry is contending with a market that changed brutally fast. Average U.S. mortgage rates are around 7.2 percent in for a 30-year fixed loan, the highest since 2001. Lawrence Yun, the chief economist at the National Association of Realtors, predicted they could surge all the way to 8.5 percent.

Applications for home purchase loans are down over 40 percent compared to last year. From June to August, luxury home sales declined 28.1 percent year-over-year, the largest fall on record, according to Redfin.

Applications for home purchase loans are down over 40 percent compared to last year. From June to August, luxury home sales declined 28.1 percent year-over-year, the largest fall on record, according to Redfin.

These shifts means that many firms, and their leaders, are now in wartime mode — forced to rapidly cut costs, scale back on investments and focus on survival. For executives who were anointed during the good times, it’s a major transition.

Meanwhile, residential-focused startups that raised gobs of capital and were in hypergrowth mode have had to pivot. They’re now chasing a position that renowned venture capitalist Paul Graham terms “default alive” — if their expenses stay constant and their revenue growth continues on the same trajectory, will they be able to keep the lights on without raising more funds?

The answer, for many, has been a hard no. Several startups have laid off large chunks of their workforce, and others are scrambling to raise money at valuations far lower than a year ago. For some, it’s a matter of time before they’re out of business.

This month, The Real Deal took a look at some of the wartime decisions taking place across the industry, and dove into the conditions causing them. Check out our coverage below:

Read more