The following is one of the hundreds of data sets available on TRD Pro — the one-stop real estate terminal for all the data and market information you need.

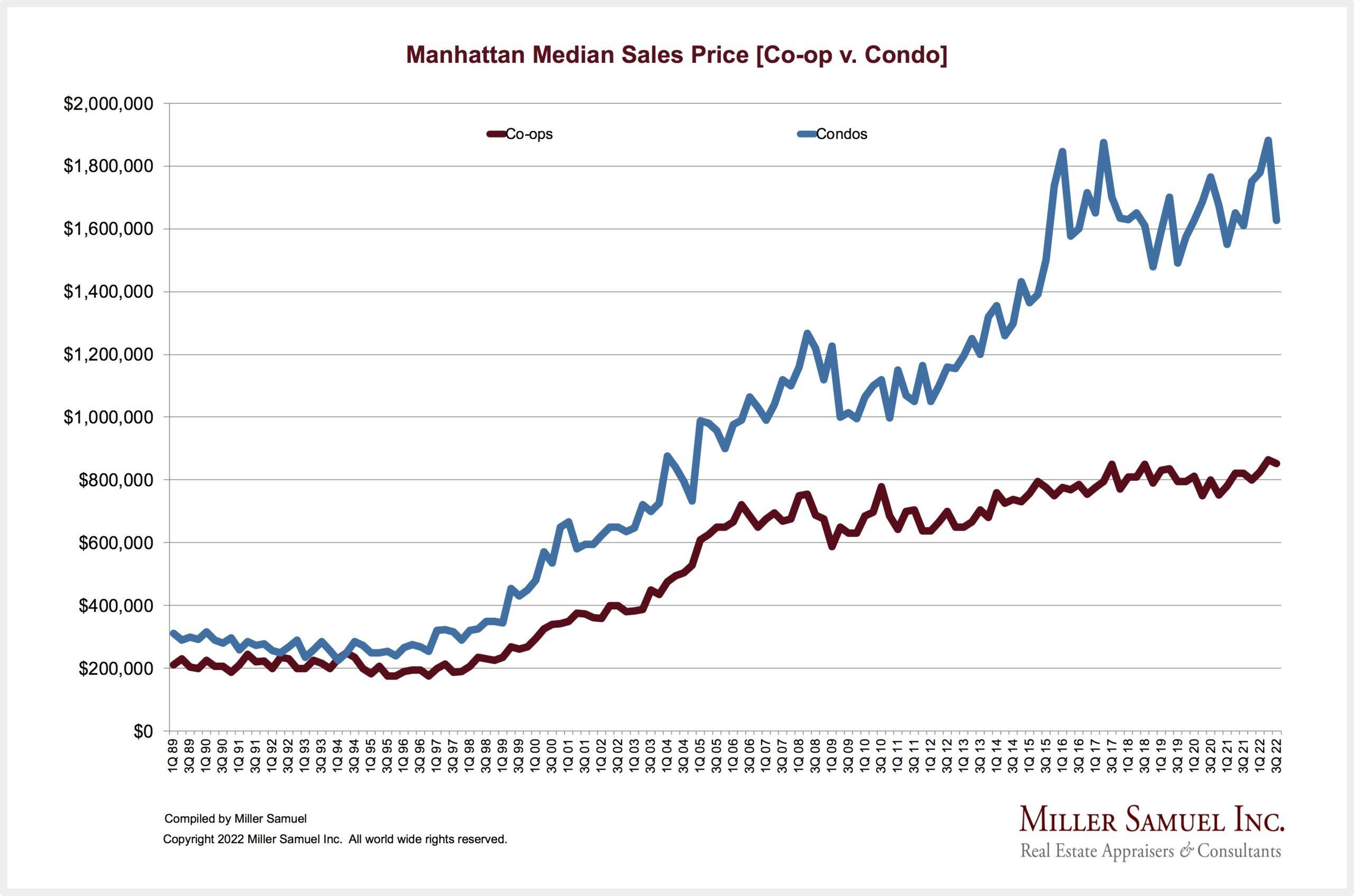

In Manhattan, condo units have been getting progressively more expensive than co-ops since the mid 1990s.

In the third quarter of 2022, the median price of a Manhattan condo apartment was $1.63 million. Co-op units, on the other hand, were around half the price at $851,000.

It wasn’t always this way.

Real estate appraisal company Miller Samuel collected data that showed a much narrower gap between the median prices three decades ago.

In the first quarter of 1989, the chart shows, condos were about 50 percent pricier than co-ops. The discrepancy shrunk over the next five years, and in the first quarter of 1994, the median price for each was just over $200,000.

But since then, the gap has consistently widened. The second quarter of 2022 represented one of the biggest price differences between condos and co-ops in the past 30 years. The co-op median sale price was $865,000, versus $1.9 million for condos.

From 1989 to Q3 of 2022, Manhattan co-ops’ median sale price increased from $200,000 to $851,000, an annualized growth rate of 4.49 percent. Condos have increased from $300,000 to $1.63 million in the same period, or 5.26 percent a year.

Several factors account for the gap. Condos are generally preferred by foreign buyers, who would rather not be scrutinized by a co-op board. Condo units are also easier for owners to rent out and represent true real estate, whereas co-op buyers acquire shares in the building, not the unit itself.

Another factor is that more condos than co-ops have been built in recent years. New units tend to sell for more than the median price, so over time that raises the median.

New York City still has more co-op inventory than condos, largely because developers converted many rental buildings into co-ops during a 1980s conversion boom.

But the surge in condo construction and the decrease in co-op conversions has closed the gap. In October, only 300 more co-op units than condo units were available, according to StreetEasy.