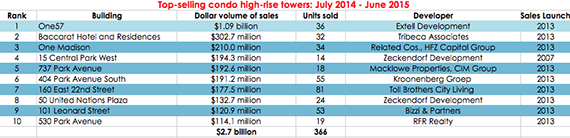

Manhattan’s 10 highest-grossing high-rise condominiums racked up total sales of more than $2.7 billion over the past year, according to a new ranking by The Real Deal. Leading the pack was Extell Development’s One57, which sold product worth a total of $1.1 billion in the one-year period ending June 2015. That’s $700 million more than its next closest competitor.

One57’s perch atop the rankings comes as no surprise, given that a single penthouse there sold to a mystery buyer in January for $100.5 million, the priciest apartment sale in New York City history. In total, 36 units were sold in the skyscraper over the past 12 months. The tower is the subject of a new report from the Independent Budget Office that looks at its 421a abatements.

Tribeca Associates and Starwood Capital Group’s Baccarat Hotel and Residences, which did total sales of $302.7 million across 32 apartments, came in second on The Real Deal’s ranking of top-selling condo high-rises. The luxury building launched sales in March 2013 and is now over 75 percent sold, according to Kelly Kennedy Mack, president of Corcoran Sunshine Marketing Group, which is handling sales.

Click to enlarge (Source: Dollar figures from The Real Deal analysis of Department of Finance data of high-rise condos. Other information gathered from StreetEasy. Total number sold is approximate.)

The Baccarat “has earned its place among New York’s most coveted ultra-luxury properties,” Mack said. “There’s been an incredible amount of global attention on the opening of the hotel, but the real excitement for the real estate community is taking place on the floors above.”

In April, a four-bedroom apartment in the building closed for $19.8 million. The building’s duplex penthouse is listed for $60 million.

Ranking third for the year was Related Cos. and HFZ Capital Group’s One Madison, the CetraRuddy-designed tower on the south side of Madison Square Park. The building, which launched sales in 2013, sold 34 units totaling $210 million in the last year.

At this point, one sponsor unit remains, and the closings in the past year were a mix of sponsor sales and resales, according to Tim Crowley, director of new development at CORE, the firm handling sponsor sales. Earlier this year, Rupert Murdoch listed his triplex penthouse there for $72 million, though he plans to keep a smaller apartment in the building. He bought the pair for $57.3 million in February 2014.

Crowley said One Madison sold out at a healthy rate, remarking that “at no point did it feel like it was selling slowly or feel like it was absolutely flying off the shelves.” The tower’s height and its corresponding lofty views helped it stand out in a mostly mid-rise neighborhood and helped sales, he said.

Of the vast gap between One57 and other high-rises in terms of dollar sales volume, Crowley said apartments in Extell’s building tend to be much larger on average.

“I would be absolutely floored if their total dollar was not a result of the aggregate square footage that makes up,” he said.

Fourth in the ranking was Zeckendorf Development’s limestone classic, 15 Central Park West, with $194.3 million in resales across just 14 units.

Taking fifth place was Macklowe Properties and CIM Group’s 737 Park Avenue, an Upper East Side prewar conversion that after numerous legal battles, launched sales in 2013. The building saw $192.6 million in sales across 18 units — a combination of resales and sponsor sales. Earlier this year, the penthouse sold for $32 million.

Total sales volume for all high-rise — defined as being 10 stories or more — condo buildings in Manhattan was $12.4 billion.

In June, The Real Deal reported on concerns over dwindling demand for uber-luxury New York City condos.

Adam Pincus contributed reporting.