The $1.3 billion tax increment financing district approved for Lincoln Yards violates state law, according to a lawsuit filed by a coalition of labor, education and neighborhood groups.

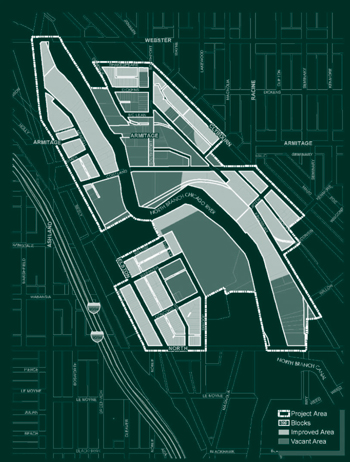

The Cortland/Chicago River TIF district would divert future property taxes inside a 168-acre area surrounding Sterling Bay’s 55-acre project into a fund dedicated to public infrastructure work around the site.

The district approved by a 32-13 vote in the City Council last week.

A map of the TIF district

The lawsuit, filed Wednesday, challenges the city’s “racially and ethnically discriminatory administration of the TIF system,” according to a statement from the Grassroots Collaborative that filed the suit, whose 11 members include SEIU Healthcare and the Chicago Teachers Union. The city’s TIF system “has disproportionately benefited areas in majority-White census tracts,” the group said. The education advocacy group Raise Your Hand is also a plaintiff on the lawsuit.

State law requires any city proposing a new TIF district to first demonstrate that the area suffers from “blight” that could only be remedied with a revenue boost.

Alderman Brian Hopkins (2nd), a vocal proponent of the new district whose ward includes the 55-acre Lincoln Yards site, said on Tuesday that he’s confident the area meets the legal standard for blight. The total cost of the Lincoln Yards megadevelopment has been pegged at $6 billion.

Some activists “think an area needs to be surrounded by low-income housing in order to be considered blighted,” Hopkins said. “But anyone who’s taken a drive down Cortland [Street] knows that there are serious infrastructure issues there.”

In a presentation to the Community Development Commission in February, city planning Department deputy Commissioner Chip Hastings said the riverfront site is “inconsistent with modern building standards” and needs tax increment financing revenue to “unlock the full potential of the site.” He also said concrete barriers along the river are “deteriorating and crumbling.”

The district could raise up to $900 million for infrastructure work during the next 23 years, plus another $400 million to pay “financing costs,” according to the ordinance passed last week. Under a separate agreement with the city, Sterling Bay would front the cost of at least $490 million in public projects under the promise of repayment, with interest, from that tax revenue raised by the city.

Those projects include construction of three new bridges over the river, extending the east terminus of the 606 pedestrian trail and revamping the busy intersection of Elston, Armitage and Ashland avenues. Work would be phased over the next five years.

Mayor-elect Lori Lightfoot had criticized the new district and initially called for its approval to be delayed until she takes office next month. But she relented after Sterling Bay agreed to raise its hiring benchmarks for women-owned and minority-owned contractors.

The council last week also green-lit the 141-acre Roosevelt/Clark tax increment financing district on land surrounding the planned site of The 78 project on the city’s Near South Side. The district would raise up to $1.1 billion for infrastructure work that would take shape under a similar agreement with developer Related Midwest.