Every day, The Real Deal rounds up Chicago’s biggest real estate news. We update this page at 10 a.m. and 5 p.m. PT. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 5 p.m. CST

Local firms Ameritus and JBG Property are buyers in Pilsen. The two companies partnered on the acquisition of the 220,000-square-foot Lacuna Lofts office property. The seller was a trust belonging to the Cacciatore family. A member of the family told Crain’s that the sale price was about $32 million, roughly meeting its asking price.

Chicago’s first casino was always a gamble, but now it may be a loser. The state gambling authority, in a newly-released study, said the casino would have a difficult time luring in investors and finding success. It also said the five potential sites on the South and West sides were not attractive options but that of those, the Michael Reese site was the best one despite opposition from the local alderman. [Curbed]

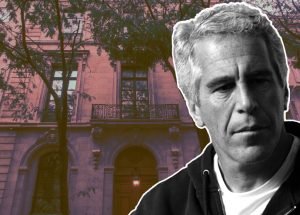

Jeffrey Epstein (Credit: Getty Images)

The FBI swarmed Jeffrey Epstein’s private island. The agency, along with local police from the Virgin Islands and New York Police Department officers, drove around Little St. James Island in golf carts and gathered evidence following Epstein’s apparent suicide in Manhattan jail on Saturday. Epstein allegedly trafficked girls through his island home. [Miami Herald]

There’s a new $100 million fund specifically devoted to construction tech. As investment in construction technology is booming, San Francisco-based Brick & Mortar Ventures launched a new fund to target Series A funding rounds. There was about $6.1 billion invested in the sector last year, nearly double that of 2017. [TRD]

U.S. mortgage rates top 2008 levels (Credit: iStock)

Is this a recession replay? Home mortgage debt climbed in the second quarter, surpassing the pre-recession 2008 peak. The total mortgage balance grew during Q2 by $162 billion to $9.4 trillion, according to the Federal Reserve Bank of New York. That’s more than the 2008 record of $9.294 trillion. [TRD]

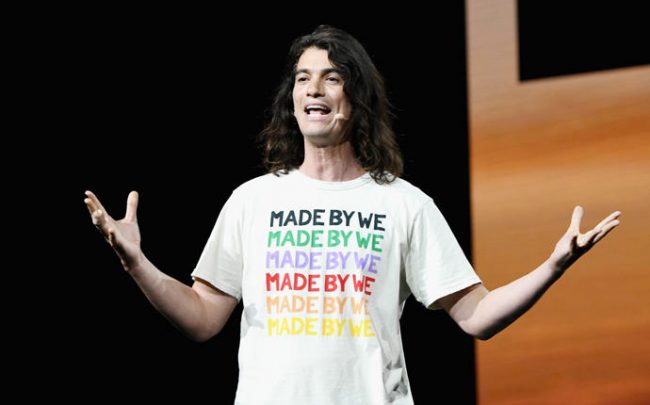

WeWork takes more space Downtown. The co-working giant, which already has over 1 million square feet of office space Downtown, inked a deal at 1155 W. Fulton Market. The firm will take 90,000 square feet in a former industrial building that Domus Special Situations Group bought in February as part of a $24 million deal, and will redevelop the space. [Crain’s]

WeWork takes more space Downtown. The co-working giant, which already has over 1 million square feet of office space Downtown, inked a deal at 1155 W. Fulton Market. The firm will take 90,000 square feet in a former industrial building that Domus Special Situations Group bought in February as part of a $24 million deal, and will redevelop the space. [Crain’s]

A new Provident Hospital may be on the way. Cook County Health intends to spend $240 million for a new eight-story facility to replace the existing public hospital at 500 E. 51st St., in Bronzeville. The state still needs to approve the construction of what would be a smaller building, located next door to the existing one. [TRD]

Chicago’s week-long condo binge The top five home sales in Chicago last week included four condo units, three of which were in Belgravia Group-owned developments. The total amount came out to just over $10 million. Home prices overall in Chicago have slowed in recent months, in line with the rest of the market nationwide. [TRD]

A German real estate fund is suing Ashkenazy over the Marriott East Side hotel. Frankfurt-based Deka Immobilien Investment GmbH and minority partner Ashkenazy Acquisition picked up the 655-key hotel for $270 million in 2015, but have struggled with it ever since. In a lawsuit filed Monday, Deka claims that Ashkenazy backed out of a deal to buy the hotel for $174 million — a 35 percent loss — after financing fell through. Deka is now seeking Ashkenazy’s $2 million deposit and reimbursement for legal fees. [Crain’s]

Luxury student housing is pushing low-income students away from campus. An analysis by Bloomberg of census data near University of Texas-Austin and the University of Michigan found a correlation between luxury student housing development and rising rents. Students from lower-income families are increasingly finding housing as far as an hour away from campus, resulting in a disconnect from campus life. [Bloomberg]

Loews Santa Monica Beach Hotel in Los Angeles

Anbang Insurance Group is close to selling its 15 luxury hotel portfolio in U.S. The total value of the portfolio is estimated at $5.5 billion. The properties include JW Marriott Essex House in New York and Loews Santa Monica Beach Hotel in Los Angeles. An affiliate of South Korea’s Mirae Asset Financial Group is working to arrange financing and reach terms for the purchase. [TRD]