Two of Chicago’s leading developers and contractors teamed up in late April to break ground on one of the city’s biggest projects.

Executives from JDL Development and Power Construction joined local officials and industry insiders at the former site of Holy Name Cathedral’s parking lot — which JDL is turning into the massive mixed-use development project One Chicago.

Prepared remarks could be faintly heard over the din of heavy machinery beginning work on the planned 77-story and 50-story towers that would rise from a 10-story podium at Chicago and State streets.

Renderings of One Chicago (Credit: Wikipedia)

The 1.5 million-square-foot development is just one of the many massive projects in the works around the city, keeping general contractors extremely busy, even at such a late-stage in what’s now a 10-year economic cycle.

One Chicago also comes late in the city’s construction boom. While the past few years have been more than fruitful for developers and contractors, a number of issues — both political and economic — threaten that success streak. Now, the real estate industry is looking at One Chicago and other major projects as a way to gauge the city’s future development landscape.

“We’re in a market where we just don’t know what to expect,” said Eudice Fogel, a luxury residential broker with Compass. “It will be interesting to see how [One Chicago] does, but it’s too early to tell.”

There’s huge projects coming up, and we need to prepare for that challenge. – Adam Jelen, Gilbane Building Company

Development projects of massive scale have risen at a rapid rate in Chicago, which saw a record level of crane activity in the past two years, according to the city. That’s been particularly good for the contracting sector, where local mainstays compete with multinational corporations to meet construction demand.

“The tower cranes are a good indicator of how the industry is doing,” said Dan McLaughlin, outgoing executive director of the Chicagoland Associated General Contractors trade group. “The big ones are really busy right now, and they have been for a few years.”

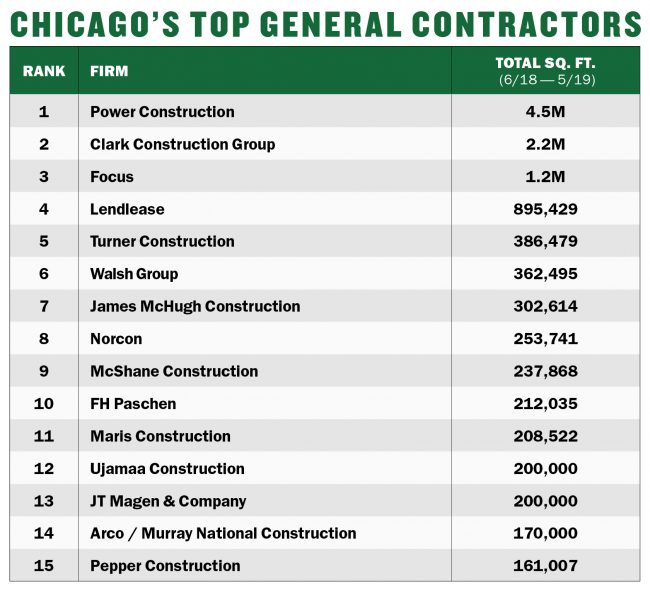

Chicago’s top five general contracting firms were approved to build over 9 million square feet of new development between June 2018 and May 2019, according to The Real Deal’s first ranking of the city’s most active general contractors.

Terry Graber, president and CEO of Power Construction

But even heavy hitters like Power, Clark Construction and Focus — the top three firms by square footage in TRD’s ranking — are grappling with rising material costs due to President Trump’s trade war with China, uncertainty about a potential recession, and a skilled labor shortage.

In more than a dozen interviews, Chicago-based development and construction professionals repeatedly pointed to their thirst for qualified workers as the most pressing obstacle facing the industry.

“It’s been a stretch of talent, of resources, of business supply chain,” said Adam Jelen, senior vice president for the Midwest division of Gilbane Building Company, which did not make this ranking. “There’s a stretch [now], but it’s also about the future. There’s huge projects coming up, and we need to prepare for that challenge.”

David Trolian of Clark Construction

Despite those challenges, Power — Chicago’s leading contractor by a landslide — shows that having local roots still holds a lot of weight in the city’s construction market.

“They have some deep, private relationships that go back a number of years,” said David Trolian, northern division president at Maryland-based Clark, which ranked as Chicago’s No. 2 general contractor, according to TRD’s analysis.

High rises

This ranking is meant to give a snapshot of the firms actively working on construction projects in the Chicago market within a one-year time period.

The tally of the top 15 general contractors over that period is based on the square footage included in each project’s planned development proposal. Only projects developed within city limits were considered and public projects were not included.

A number of full-service development firms also handle a significant amount of general contracting projects. Those companies — including Onni Group, CAVentures and LG Construction + Development — were not considered, however, because of the amount of self-awarded construction work.

Power, the city’s top contractor in this ranking and previous rankings by other publications, landed permits for nearly 4.5 million square feet of new construction between May 2018 and June 2019 — more than twice as much as second-place Clark, which was cleared to build about 2.2 million square feet.

Chicago-based Focus (formerly known as Focus Development) came in third, with 1.2 million square feet, followed by the Australian construction giant Lendlease, which was cleared to build 895,429 square feet in the city.

Both local contractors beat out the global giant Lendlease and national behemoth Turner Construction.

“We’ve tried to find our niche, and it’s diversity,” said Focus CEO Tim Anderson. “We can do the suburban three-story wood project, or we can do 30-story high-rise in Chicago. We’re not going to do a 100-story high rise, but if you have an 18-story high-rise building with 40,000-square-foot floor plates, we’re going to be able to find what works best for the client.”

Bert Brandt of Lendlease Chicago

Bert Brandt, general manager of Lendlease Chicago, which tackled its first project in the city 2014 as a developer-builder on the Cooper apartment building in the South Loop, said there are benefits to having a foot in both worlds.

“It allows for the ability to be very collaborative and upfront in our design approach and development thought process,” Brandt said. “The construction group can benefit from the added work and revenue.”

New York-based Turner Construction — which was embroiled in bribery and bid-rigging scandal allegations at Bloomberg LP’s Manhattan headquarters in 2018 — rounds out the top five firms in Chicago with 386,479 square feet.

Representatives for Turner did not respond to multiple requests for comment.

Local heavy hitter

For Power, the rise to the top is the culmination of deep roots in the Chicago market.

The local firm was founded in 1926 as a suburban homebuilder and then spent the 20th century carving out a specialty as a builder of schools and hospitals. Power was able to springboard its achievements through a major hiring surge in the 1990s and 2000s, working its way toward Downtown high-rises like One Chicago.

Despite its dominance in the Chicago market, Power maintains a relatively low public profile.

Sterling Bay’s Gr333n

Even excluding high-profile office projects like Sterling Bay’s Gr333n or Trammell Crow’s West End on Fulton, the firm’s multifamily division would have almost had enough projects approved to land the top spot on their own.

That’s largely thanks to the One Chicago mega-development, which Power began constructing for JDL in March. The towers will hold a combined 869 residences, while the podium will hold commercial tenants such as Whole Foods and Lifetime Fitness.

JDL did not return calls and Power’s executives declined to comment for this story.

At over 1.5 million square feet, One Chicago is the second biggest project considered for the rankings, behind Howard Hughes Corporation and Riverside Investment & Development’s office development at 110 North Wacker Drive.

Power is also the builder behind Crayton Advisors and White Oak Realty’s 273-unit Milieu on the Park complex in Fulton Market, as well as Draper & Kramer’s South Loop apartment project, which will bring 275 rentals to the neighborhood, among a handful of other projects.

Gordon Ziegenhagen of Draper & Kramer

“They’re doing so much in the multifamily market,” said Gordon Ziegenhagen, vice president of acquisitions and development for Draper & Kramer.

Some of Power’s domination over the Chicago market can be attributed to its status as a longtime local player, sources said. But among the top five general contractor firms in the city, according to TRD’s analysis, only two are headquartered in Chicago: Power and Focus.

And while many of the top firms in the city are also regional powerhouses, Power works almost exclusively in the Chicago market. Clark’s Chicago office, by comparison, manages the parent company’s work in Wisconsin, Michigan, Tennessee, New York and Colorado.

As a result, Power has held onto its institutional legacy, winning contracts last year to build a nearly 500,000-square-foot extension to Rush University Hospital and an 8-story dormitory for Loyola University.

Power is also overseeing construction of a new GEMS World Academy school in Lakeshore East, the mini-neighborhood that is home to a massive development site from Magellan Development Group and Lendlease. The contractor has “always been in the mix” for Magellan’s projects, according to the developer’s president David Carlins, who pointed to Power’s extensive track record and homegrown credibility.

“[Power] has been hanging around the hoop for a long time,” Carlins said, citing its long list of university projects. “We like their culture … they’ve always been very approachable.”

The local company also scores points for pouring concrete on its own, instead of handing that task off to subcontractors, said Kevin Farrell, chief operating officer of the Chicago-based national developer Fifield Companies.

“If you control the concrete, then you control the most critical element of the schedule, which is getting that shell up,” Farrell told TRD, noting that McHugh and W.E. O’Neill also pour concrete in-house.

Comfort zones

Unlike the vast patchwork of investment and development firms each trying to carve out a niche in the city or suburbs, most general contracts for high-profile projects tend to land among the same roughly half-dozen familiar developers.

Their exclusivity is evident on TRD’s ranking, which shows a steep drop-off in volume after Lendlease. In part, that’s because property owners prefer predictability, according to several industry sources.

Magellan Development Group has repeatedly turned to McHugh for its Lakeshore East high-rises. That includes the 101-story Vista Tower, one of more than 20 high-rises the two companies have built together.

If you mess up an office, maybe you need to repaint it. If you mess up a data center, maybe the whole thing won’t work. – Geoff Arend, J.T. Magen

Fifield has also tapped McHugh for multiple recent projects, including the 188-unit mixed-use complex at 740 North Aberdeen Street.

“If you work with any of these firms long enough, you build up a level of trust and familiarity, and you need that,” Farrell said. “You need to know that if you can call your construction superintendent when he’s out on a fishing trip on a Saturday morning and tell him about it.”

Clark and major Downtown developer Riverside Investment & Development make another frequent pair. The firms first connected on Riverside’s 150 North Riverside — a 54-story, 1.2 million-square-foot office tower along the Chicago River that was completed in 2017.

Now, Riverside, Clark and Dallas-based Howard Hughes are teaming up to build the Bank of America office tower at 110 North Wacker Drive, the biggest development underway in the city’s central business district. Riverside and Clark will soon team up to redevelop Union Station, including the construction of the 50-story BMO Tower.

Developers and general contractors might first link up through a competitive bidding process. But if a project goes smoothly — and if a contractor performs well — it could be the start of a lasting and lucrative relationship.

“In a busy market like this, there’s been a lot of teaming between developers and contractors,” said Trolian, Clark’s top executive in Chicago. “Given a chance to perform well for a developer, and the reward being you continue to build for them, that’s really the ideal relationship.”

Other developers prefer to spread the wealth around.

Despite being two of the longest-standing firms in their respective fields, Draper & Kramer and Power Construction are teaming up for the first time on the developer’s South Loop apartment project.

The firms have been familiar with each other for years, Ziegenhagen said. Prior to sending out requests for bids, the developer will bring in general contractor to help with budgeting a project — work that usually does not come with a fee. Power has been one of those firms in the past, he noted.

“You have to think about. Who do you want to spend the next two years of your life with?” Ziegenhagen said. “Who can you stand to be around, and who do you trust? We want the best price, and the best team.”

New on the block

The network of pre-baked relationships between developers and contractors sets a high hurdle for new firms entering the market, like when New York-based J.T. Magen expanded into Chicago in 2001.

Similar to other less established contractors in the Chicago market, J.T. Magen’s only option was to prove it could fulfill projects that others couldn’t.

Geoff Arend of J.T. Magen

At the time, businesses were still reeling from the dot-com bust of the early 2000s, and the trial by fire gave the new firm an opportunity to make a name for itself, said Geoff Arend, who heads J.T. Magen’s Chicago operation.

“At that point, everyone had been building up their staff and assuming nothing would change,” Arend said. “So when everyone got creamed, we were able to take a model to get more out of our existing resources.”

J.T. Magen took advantage of the recession by winning contracts from companies forced to consolidate offices, like when Bank One — later acquired by JPMorgan Chase — shrank to 600,000 square feet at 131 South Dearborn Street.

The firm later branched out to data centers, precisely because of how difficult they are to build, Arend said. J.T. Magen broke ground last year on a 200,000-square-foot data center for CoreSite Realty Corporation that involved relocating utility lines to make sure the facility had enough power.

“It’s about finding those niche markets where you can add value, and where there are real barriers to entry,” Arend said. “If you mess up an office, maybe you need to repaint it. If you mess up a data center, maybe the whole thing won’t work.”

Summit Design + Build also prides itself on taking on especially difficult jobs, a tendency that’s helped fuel its “aggressive expansion” during the past several years, according to vice president Ken Swartz.

JT Magen’s CoreSite data center (Credit: McShane Fleming Studios)

The firm has managed four-month turnarounds on $10 million renovation projects for WeWork, and its recent reconstruction of Thor Equities’ office building at 905 West Fulton Street saw it demolish half the building while remodeling the other half and replacing its facade.

“Our desire to do difficult jobs is part of what sets us apart,” Swartz said.

Summit Design + Build is also underway on a ground-up building, a 105-unit CityPads apartment complex in Edgewater.

Doing it all

Other construction firms, like Lendlease, have managed to stand out by branching out past the traditional role of construction companies.

The Australia-based company, which has divisions throughout the world, has overseen construction in Chicago since 1976, but only in 2014 did the firm ramp up its development business in town.

Lendlease is working on a massive Southbank development in the South Loop, where the luxury Cooper apartment building was delivered last year. The firm is also partnering with Magellan on a sprawling three-tower development in Lakeshore East, which has not yet begun work.

Just missing TRD’s top 15 ranking, Chicago-based Clayco was founded in 1984 as a traditional construction firm. CEO Bob Clark later added new branches to oversee development and architecture and last year, the company acquired Lamar Johnson Collaborative, putting more than 200 architects under its umbrella.

A rendering of West End on Fulton, 1375 West Fulton Market

The firm now identifies as a “design-build firm,” resisting any label that ties it to a specific sector of the development process, according to executive vice president Kevin McKenna. Its evolution followed a larger shift in the way businesses think about ground-up construction, McKenna said.

“It used to be that a corporation would go hire an architect who would work in a silo for eight to 10 months, and then incorporate a contractor later,” McKenna said. “Our founder [Clark] recognized very early on that that approach was flawed.”

Having one company oversee every step from blueprints to topping out means the project will “have fewer gaps, take less time, and end up with a better quality product,” he added.

Since this ranking does not factor in projects that were constructed and principally developed by the same firm, developments like Clayco’s new apartment mid-rise at 4555 North Sheridan Road were not included.

Focus, meanwhile, has moved in the opposite direction as Clayco. Before the last recession, the Chicago-based firm only oversaw construction for its own properties, according to Anderson, its CEO.

But some contracts end up planting the seeds for more partnerships down the road, he said, noting that it’s “a relationship business, after all.”

Focus has since grown its business for third-party contracting work, like the 220-unit Logan Apartments, which it began building for Fifield this year.

Bidding for independent contracts “diversifies our business model and lowers our risk profile while allowing us to grow the organization,” Anderson said. “Plus, we learn things when we work for other people.”