Each day, The Real Deal rounds up Chicago’s biggest real estate news. We update this page in real time, starting at 10 a.m. Please send any tips or deals to tips@therealdeal.com.

Amazon CEO Jeff Bezos and Hillwood Investment Properties’ 3639 Howard Street in Skokie, Illinois (Credit: Getty Images and Hillwood Investment Properties)

Did Amazon just makes a big play in Skokie? An undisclosed e-commerce company has signed one of the largest Lakeshore Corridor deals this year at Skokie Commerce Center. Meanwhile, Amazon has posted a job listing at the Skokie Commerce Center mailing address. [TRD]

Murphy Development, CIM Group refinance big South Loop apartment tower. The duo landed a $150 million refinance on the 500-unit Paragon along South Michigan Avenue. The Deutsche Bank loan will pay off construction debt from PNC Bank, with $58 million left over. [Crain’s]

Holiday Inn plans a second Tinley Park location worth $14.5 million. With 108 rooms, the hotel will compete with Marriott’s $32.7 million investment in two planned Tinley Park hotels. [Chicago Tribune]

PepsiCo may move its Chicago offices to revamped Old Post Office in Loop. Neighbors hoped the building would draw business from outside Chicago, but PepsiCo would be jumping six blocks from its West Loop office. [Crain’s]

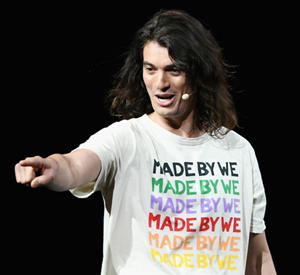

After backlash, WeWork added a woman to its board. The office-space provider’s parent company, the We Company, is adding Frances Frei to its board ahead of its public offering. Frei is a professor of technology and operations management at Harvard Business School, and has consulted the We Company since March of this year. The company faced public scrutiny for revealing an all-male board in its S-1 filing with the U.S. Securities and Exchange Commission. [Reuters]

Tucker Development CEO Richard Tucker and the Purple Hotel (Credit: Wikipedia)

Tucker Development will spend $170 million to redevelop the site of the old Purple Hotel. The developer will break ground on the empty lot in Lincolnwood next March, with plans for two hotels, 300 apartments, and 70,000 square feet of retail space. The hotel, known for scandal, parties, and organized crime, was torn down in 2013. [TRD]

Horizon Realty secured $30 million from Wells Fargo by refinancing two rental buildings in Sheridan and Buena Park. The financing comes as the company with new ownership and new offices plans for a senior living high-rise. [TRD]

Chicago’s three priciest listings this week were single-family homes, all listed by Berkshire Hathaway HomeServices’ Mario Greco. They have 12 re-listings between them since they first hit the market, as luxury single family homes have been slow sellers this year. [TRD]

A triple-lot Howard Van Doren Shaw Mansion hit the market for $2.18 million. The 1902 home in Kenwood is one of 25 structures Shaw built by the early 20th century. He would later make his name designing downtown Chicago and Lake Forest estates. [Crain’s]

Kimball Station, a 59-unit apartment building in Albany Park, sells. Chicagoland Multifamily DST purchased the building for $15.24 million from developer Inland Private Capital. [Daily Herald]

WeWork CEO Adam Neumann (Credit: Getty Images)

WeWork’s IPO roadshow could start next week. The office-space company is aiming to sell about $3.5 billion in shares in the much-hyped event, and already has secured a commitment from major banks for a $6 billion credit facility. [Bloomberg]

Foreign investors are fleeing the U.S. For the first time since 2013, overseas investors sold $13.4 billion in commercial real estate — more than they acquired last quarter. The trend comes as the U.S. bull market matures and uncertain geopolitics have diminished confidence in the local market. [WSJ]

Contactually clients feel abandoned after Compass acquisition. The startup, which provides a customer relationship management tool, has recently told existing clients that it has limited ability to support them, as the majority of its resources have been diverted to building technology for Compass. [Inman]