Every day, The Real Deal rounds up Chicago’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page throughout the day, starting at 10 a.m. Please send any tips or deals to tips@therealdeal.com.

227 West Monroe Street and Amazon CEO Jeff Bezos (Credit: Stone Real Estate and Getty Images)

Amazon will add 70,000 square feet to its lease at Tishman Speyer’s Franklin Center office tower at 227 West Monroe Street. The announcement comes as Amazon hires 400 new Chicago Tech Hub employees. [TRD]

From left: 38 East Elm Street; 432 West Grant Place, Unit 1E; 25 East Superior Street E $4602 (Credit: Redfin)

Four out of five of this week’s priciest listings were condominiums, which these days tend to fare better than single-family homes in Chicago’s luxury market. But there was one notable exception, in a 1920s-era red brick mansion. The list also includes a unique listing at the Heritage, a condo with a Japanese garden that has water misters, a lily pond, and a waterfall. [TRD]

Judge Neil Cohen dismissed the activist lawsuit against Lincoln Yards, which contested a $1.4 billion subsidy. Activists claim the tax break was discriminatory and based on expired data. Cohen’s opinion said that the plaintiffs had not been directly harmed, but a new group of plaintiffs may file another suit. [Block Club]

The Chicago Cubs’ owners, the Ricketts family, secured a $140 million refinancing for the Wrigley Field redevelopment. The original construction loan paid for Gallagher Way plaza and Hotel Zachary near the ballpark. The family plans to stimulate revenue and draw fans with the development. [Crain’s]

A home automation company backed by Blackstone Group is merging with a unit of SoftBank. Vivint Smart Home Inc. will create a company valued at $5.6 billion through the merger. The company makes a variety of smart home security products. [Reuters]

A ‘flying saucer’-shaped home listed in Riverwoods isn’t getting any out-of-this-world offers. Architect Edo Belli designed the home for himself in 1977, giving the 4,600-square-foot pad angled stilts to mimic a spaceship. It is now on the market for $785,000. The seller, Ella Bernshtam, is represented by her husband, Leonid Belorousski of Kale Realty. [Crain’s]

Google CEO Sundar Pichai and Google’s Midwest headquarters in Fulton Market (Credit: Getty Images and Google Maps)

Local developer Mark Goodman & Associates has received its first construction permit for a site near Google HQ. The 13-story office building at 310 North Sangamon Street will have 268,000 square feet of office space, 7,800 square feet of retail, a fitness center, a bike room and a terrace. The site once housed AmeriGas’ propane facility. [Curbed]

The Batavia City Council will allow an alteration of the Winding Creek residential subdivision development plan. The property has two cell towers whose leases complicated the plan. Developer M/I Homes will proceed with three fewer houses than originally planned. [Daily Herald]

A mostly-vacant office at 1717 Deerfield Road sells as a value-add deal. The three-story Deerfield office that was just 21.2 percent leased has sold with a low price-per-square-foot. Schaumburg-based Helios Property Management and a Canada investor bought the 147,000-square-foot building. [Connect Media]

Bernie Sanders (Credit: Getty Images)

Bernie Sanders is making a call for national rent control. The $2.5 trillion affordable housing plan would also focus on ending homelessness. It would expand public housing, increase the amount of affordable housing and limit annual rent increases to no more than 1.5 times the inflation rate or 3 percent. The campaign will release the full plan within the next month. [NYT]

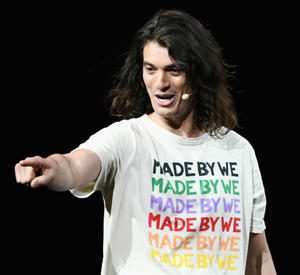

WeWork CEO Adam Neumann (Credit: Getty Images)

WeWork’s IPO valuation just keeps getting lower. Sources have now told Reuters that the co-working giant may seek a valuation between $10 and $12 billion for its initial public offering, a dramatic decrease from the $47 billion valuation it hit in January. Its dropping valuation could impact other real estate startups as well. [Reuters]

And it turns out Adam Neumann is no Mark Zuckerberg. The WeWork co-founder’s reluctant decision to cede some of his powers as the company prepares to go public is an indication that the era of founders taking their companies public while still maintaining strong voting power is over. [Bloomberg]

Markets are starting the week on a high note. TRD’s analysis of 28 real estate stocks found that they did better than the S&P 500, increasing by more than 3 percent. However, 19 of the companies saw their share prices plunge on Friday. CoStar Group’s value fell the most, dropping by 7.7 percent to close on Friday at $570.11, while Newmark Knight Frank did the best, rising by 14.4 percent to close at $10.11. [TRD]

George Kaufman’s third wife and longtime lawyer are in a bitter dispute over his $500 million estate. The developer amended his will two months before dying to remove lawyer Thomas Kearns as a trustee and executor and giving the private wealth management company Bessemer Trust control of his estate. An attorney for Kearns says Kaufman was isolated and abused for months by his wife Mariana Zoullas Kaufman, which her attorney has disputed. [WSJ]

A criminal hack at the Corcoran Group on Friday caused the entire company to get an email with agent splits. The email also included marketing budgets and gross commission income, according to TRD. The email came from Corcoran sales president Bill Cunningham and was retracted quickly. The hack appeared to be contained to one email account, and customer data was not involved. Corcoran plans to investigate the hack as criminal activity. [TRD]