Singaporean wealth fund leads $6.8B deal for U.S. industrial properties

Singaporean wealth fund leads $6.8B deal for U.S. industrial properties

Trending

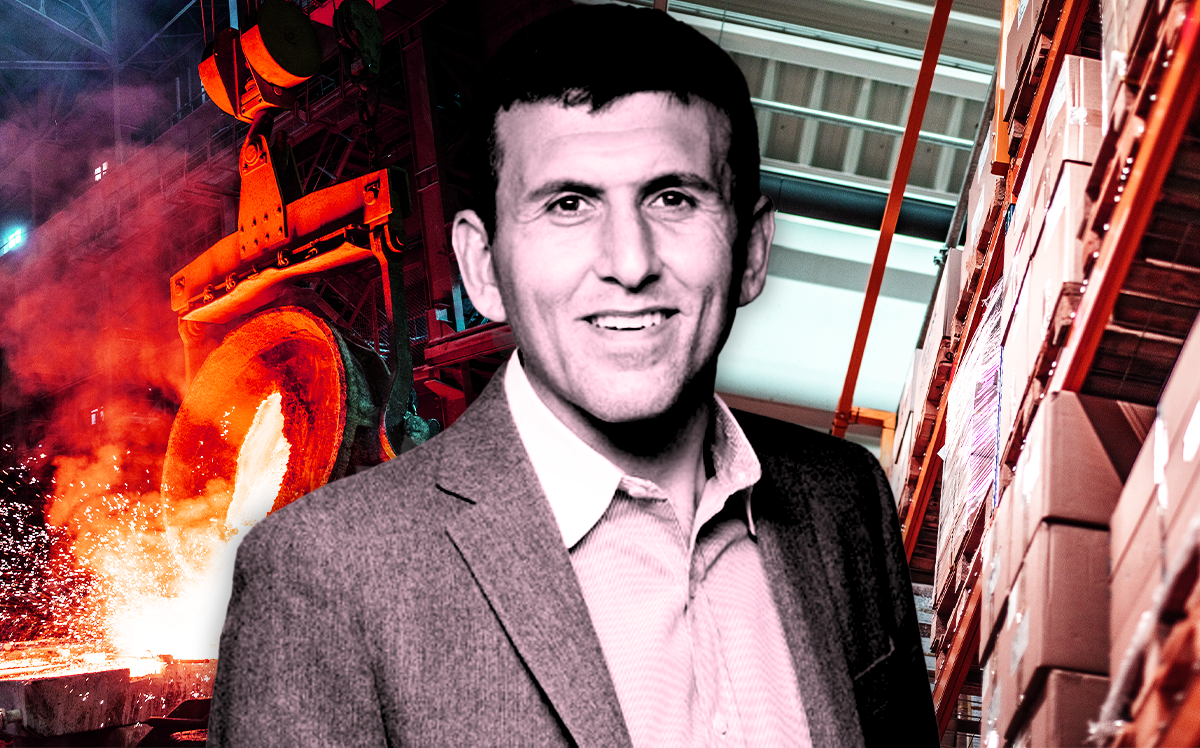

Speedwagon Capital plans to redevelop former steel mill into industrial site

Site is located 25 minutes from the greater Chicago area

A private Chicago investment firm just purchased a former steel mill from one of the largest steel manufacturers in North America.

Speedwagon Capital Partners, which plans to redevelop the mill into an industrial site, acquired the property from Cleveland-Cliffs, the Chicago Business Journal reported. Neither company disclosed the specific financial terms of the deal.

The site is located in northwest Indiana, 25 minutes from downtown Chicago. Speedwagon Capital, which focuses on identifying unique, inefficient and dislocated opportunities in real estate, said the site is well suited for industrial redevelopment. The property, which is accessible from multiple interstates, features on-site rail access, barge access to Lake Michigan and more than 300 megawatts of power.

“We are very excited about the favorable logistical and supply chain attributes that this premier industrial location offers,” Speedwagon Capital Partners Senior Managing Director Steve Khoshabe said in a statement.

In addition to the former steel mill, Speedwagon also bought a stake in a $130 million industrial real estate portfolio. That purchase covers 2.2 million square feet across 41 buildings in the greater Chicago area and throughout southern Wisconsin.

The firm has also diversified its portfolio recently with more than a dozen investments in various operating companies. In June, Speedwagon participated in a $25 million capital raise for Bitcoin mining company Blockware Mining. Two months later, in August, the firm also contributed to a $38 million Series B financing for mobile game developer Nifty Games Inc.

“We are pleased with the performance of our portfolio and continue to target and evaluate attractive opportunities across a variety of asset classes and industries,” Khoshabe said.

The U.S. industrial real estate market had a record third quarter this year, thanks in large part to pandemic-driven demand for logistics space to cater to the growing e-commerce sector.

Read more

Singaporean wealth fund leads $6.8B deal for U.S. industrial properties

Singaporean wealth fund leads $6.8B deal for U.S. industrial properties

[CBJ] — Victoria Pruitt