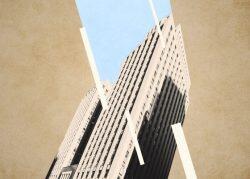

Chicago healthcare investment firm Linden Capital Partners is doubling its office space with a move to a top floor of the city’s second-most valuable building in another deal demonstrating the consolidation of demand into the uppermost tier of properties.

Linden signed a lease for 28,000 square feet on the 55th floor of the 1.5 million-square-foot Bank of America Tower at 110 North Wacker Drive that opened in 2020, the company’s president Tony Davis told Crain’s.

The firm next year will exit a 13,000-square-foot lease at 150 North Riverside Plaza, a West Loop building completed in 2017 and owned by Wanxiang American Real Estate and Riverside Investment and Development, a firm started by John Buck Company veteran John O’Donnell.

Terms of the new lease weren’t disclosed. Crain’s, citing unidentified people familiar with the negotiations, reported that Linden could be paying more than $50 per square foot per year, not including taxes and operating expenses, which tenants are also typically responsible for. Commercial real estate brokers said that would be among the highest rents ever paid for an office in Chicago, according to the outlet. Standard net rents in top downtown buildings fall between $40 and $45 per square foot.

The lease illustrates the disparity between office buildings in the Loop. Its high price was agreed to even as record vacancies of 21.2 percent in the first quarter hurt property owners in the central business district. Older buildings, like those on LaSalle Street – including 135 South LaSalle that Bank of America exited for more than 500,000 square feet at 110 North Wacker – are having an especially tough time drawing new tenants. Office users have tended to downsize while striking new leases amid the pandemic’s work-from-home environment.

New developments with quality amenities like the Wacker property and Fulton Market buildings in the West Loop haven’t been hit as hard by the health crisis. Linden’s new building was more than 82 percent leased as of early last month, with several law firms signed as long-term tenants, including Jones Day, Morgan Lewis & Bockius, Perkins Coie, King & Spaulding and Cooley, Crain’s reported.

Linden Capital has about 50 employees today, and expects to add another 25 in the next year, the outlet reported. The firm plans to sublease its existing space, which it leases through 2028.

The new lease is a win for a joint venture of Chicago-based Callahan Capital Partners and New York-based Oak Hill Advisors, which just paid Houston-based Howard Hughes $210 million for the controlling equity stake in the Wacker Drive building. The deal valued the building at more than $1 billion, the second-highest valuation for a Chicago office building, behind only Willis Tower’s $1.3 billion sale in 2015. The Callahan and Oak Hill joint venture obtained a $559 million loan against the property earlier this year.

Brad Serot and Justin Hucek of CBRE represented Linden in negotiating the lease, and Christy Domin and Drew Nieman of Riverside negotiated on behalf of building ownership prior to the property sale.

[Crain’s] – Sam Lounsberry

Read more