Chicago’s supply of industrial real estate keeps shrinking, setting new record lows.

With so much unmet demand for warehousing and logistics operations, competition for spaces in big box buildings is tougher than ever. Industrial tenants sunk the Chicago area’s vacancy rate in buildings of at least 200,000 square feet to just 2.6 percent in the first quarter, a historic low, Colliers found.

The fourth quarter vacancy rate of 3.7 percent fell by more than a quarter to start 2022, and the measure is down from 8.2 percent year-over-year. New leasing totaled 9.7 million square feet in the first quarter with Amazon taking the two largest deals at over 1 million square feet each in Joliet and Kenosha facilities.

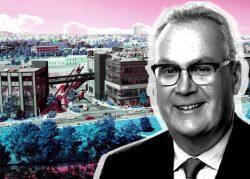

The imbalance in the market is putting pressure on developers such as Aaron Martell’s Logistics Property, the recent buyer of $90 million in local real estate including a Goose Island parcel where the company is planning Chicago’s first two-story warehouse among the 1.7 million square feet of projects it has underway in the area.

“No one with industrial experience over the last 30 years would have predicted this environment for demand,” Martell told The Real Deal.

In the most concentrated submarket, supply is even thinner. Almost half of the area’s big box product is in the Interstate 80 Joliet and Interstate 55 corridors. Vacancies in those two pockets respectively dropped to “previously unfathomable” levels of 1.5 percent and 0.7 percent, Colliers said.

Developers are reacting, setting records for the development pipeline in the first quarter with 44 buildings totaling 23.7 million square feet underway.

“Developers have been pushing to secure financing and materials to develop new speculative projects to meet demand,” Colliers said. “This trend is expected to only accelerate due to the tight market, with dozens of buildings being announced each month.”

Read more