Another fat profit on an investors’ exit from Chicago-area condo deconversions revealed this week adds to evidence that the drama behind the tough deals is paying off.

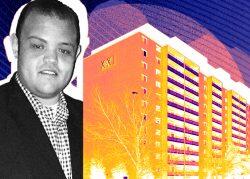

The 262-unit Manda Lane apartment complex in suburban Wheeling was bought by Robert Kaplan’s Chicago-based company Ansonia Properties for $46 million, public records show. The deal provided the seller, VennPoint Real Estate, an 84 percent markup from its 2019 acquisition cost, the records indicate.

VennPoint, based in suburban Schaumburg and co-founded by Nick Marietti, achieved the profit after taking the property through a complex process known as a condo deconversion. The homes were previously owner-occupied condos, then VennPoint made an offer that was accepted by at least 75 percent of the property’s ownership through a formal condo board vote to disband the condo association and turn the complex into a traditional apartment rental asset.

As part of that process, VennPoint bought 115 of the condos from various individuals for a total of $10.4 million after striking a deal with an entity that controlled 147 units for $13.4 million to make its total entry cost $24.9 million.

Neither Ansonia nor VennPoint returned requests for comment.

While condo deconversions frequently spark controversy since the deals have the potential to strip ownership from unwilling sellers once the 75 percent threshold is reached, the transactions lately have netted wide margins for sellers like VennPoint and Mo2 Properties, which just sold an 80-unit former condo asset in Chicago’s Lakeview neighborhood after a three-year hold, as well. Such deals show why deconversions have kept momentum since they started sweeping through the area in 2015.

The condo owners who agree to sell usually get above-market prices, since condo values haven’t recovered well from the Great Recession in Chicago. And a strong multifamily market buoyed by rising rents in the area gives deconversion buyers the chance to make money on leases or with a flip to a new buyer, even while paying the condo owners more than their home would be worth as a single unit on the open market.

Yet deconversions are often slowed down by holdout unit owners and litigation. Rising interest rates are another headwind.

With the soaring costs of new construction and recent rent growth, though, there is still reason for investors to consider taking the potentially combative deconversion route to expand their multifamily portfolios.

Ansonia and VennPoint each own several other large apartment complexes throughout the Chicago area.

Read more