Swedish private equity firm EQT Exeter is seizing on its new partner’s familiarity with the Chicago multifamily market.

After acquiring Chicago-based apartment landlord Redwood Capital Group earlier this year, a venture of EQT shelled out $85.5 million for a newly built 380-unit apartment complex in suburban West Dundee, about 40 miles northwest of the Loop, public records show.

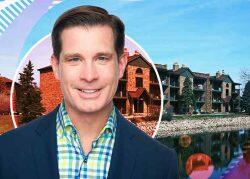

The seller in the off-market deal was an affiliate of Milwaukee-based Fiduciary Real Estate Development, which developed the 19 separate two-story buildings at 400 Randall Road, breaking ground in 2019 and completing the first 300 units last year. The second phase, including the final 80 units, was completed earlier this year, EQT said in a statement.

David Carlson of EQT said in the statement he’s “very bullish” on multifamily in certain pockets of suburban Chicago’s multifamily market, and that there’s strong demand for new units in areas such as the outer northwest suburbs, a submarket that’s had a dearth of apartment development in the last 20 years.

Fiduciary originally marketed the apartments as the Seasons at Randall Road, and they’ve been rebranded to Reserve Randall Road. Fiduciary didn’t return a request for comment.

The sale marks the latest large apartment complex to trade hands in Chicago’s western and northwest suburbs this year. Both new development and older properties have fetched sellers big profits this year, including a record for the highest price on a suburban complex set just days ago by Albion Residential’s purchase for nearly $140 million of the 612-unit Bourbon Square property in Palatine.

“We know how hard it is to develop in the suburbs,” Albion’s Jason Koehn told The Real Deal. “If you look over the collar counties and everything around the city, there just isn’t a whole lot of supply delivered.”

As construction costs rose amid the pandemic, the price of buying existing buildings is more attractive than pursuing new development for many multifamily players, he said. That has fueled the frenzy for big apartment complexes, including this year’s $111 million sale by FPA Multifamily of a 612-unit Rolling Meadows complex built in 1962.

Reserve Randall Road includes studio apartments up to three-bedroom layouts. The Kane County asset fetched among the highest prices for a recently built apartment complex sold in the suburbs this year. A DuPage County property to the south, the 162-unit luxury building Winfield Station, where construction finished last year, sold for $273,000 per unit this spring, more than the Reserve Randall Road’s implied value from the EQT purchase of $225,000 per unit.

Read more