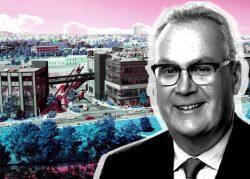

Chicago’s Logistics Property secured $150 million in financing to build the city’s first multistory warehouse.

The firm got the construction loan from Wells Fargo, Inland Bank and Trust and Associated Bank for its planned 1.2-million-square-foot, two-story logistics facility on an 11.5-acre site at the intersection of Division Street and Elston Avenue, near Goose Island.

“Our success would not exist without our lenders,” Katherine Bernstein, the industrial real estate firm’s senior vice president of capital markets, said in a statement.

Logistics Property Co. bought the property for $55 million earlier this year along with three others as part of a $90 million spending spree. Though the industrial market shows signs of cooling, demand still outweighs supply. The firm’s four purchases added almost 1.7 million square feet of space to the local development pipeline as tenants wait for developers to finish projects to relieve historically low supply.

The firm, founded by James Martell and other former Ridge Development leaders in 2018, has developed more than 55.3 million square feet of logistics buildings since 1995, and its portfolio comprises 52 buildings across 23 million square feet in North American markets with an estimated value of more than $3 billion, according to its website.

Aaron Martell, its central region executive vice president and son of the founder, previously told The Real Deal that the firm’s recent good luck with land acquisitions is a reflection of strong capital source and expertise “so that brokers believe in our ability to execute.”

Vacancies in Chicago-area industrial buildings of 200,000 square feet or more rose for the first time in nearly two years last quarter, according to Colliers, showing the impact on demand of developers putting a record amount of projects in the pipeline. Still, supply remains tight and rental rates are expected to rise even if it’s at a slower rate than the past two years.

Read more