Coming off a win that secured a big tax break and raised the eyebrows of Cook County Assessor Fritz Kaegi, a venture of Goldman Sachs and Chicago’s Magnolia Capital is ready to make a sale.

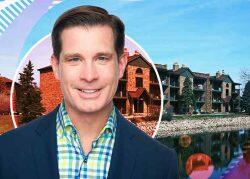

A partnership of the financial institution and Magnolia, which is led by CEO Maxwell Peek, is marketing the 21-story Vantage apartment complex in Oak Park for sale. The landlord of the 270-unit building, the western suburb’s tallest, has tapped John Jaeger’s CBRE multifamily brokerage team to sell the property, according to social media posts that show offers can be submitted soon.

The listing comes a year after the property owner notched a big win with the Cook County Board of Review, which sliced Kaegi’s $90 million valuation of the property nearly in half to $54 million, according to published reports.

“The assessor selectively picked on properties with recent sales and gave zero consideration for their income-producing capabilities,” said Jeffrey Holland, an attorney who was part of the successful appeal to the Cook County Board of Review that lowered Vantage’s tax bill. “An income approach utilizing the subject’s actual income and expenses is the most fair and consistent methodology.”

Kaegi recently kicked off a new triennial cycle of issuing updated assessments to determine the values at which to tax real estate. So far, he’s doubling down on hitting commercial property owners harder, a reflection of his philosophy that single-family homeowners have shouldered an undue amount of the area’s property tax burden and commercial owners have gotten away with undervaluations.

Goldman declined to comment and Magnolia didn’t return a request for comment.

Though an asking price isn’t included with the marketing materials made public so far, Vantage is likely to fetch a price over the $102 million the Goldman venture paid to buy the property from developer Lee Golub, who completed the project in 2016. Other multifamily properties in suburban Chicago developed both last decade and long before have procured thick profit margins for sellers this year when they’ve tested the market.

Albion Residential, for instance, set a suburban record for a multifamily asset by paying nearly $140 million for the 612-unit Bourbon Square property in Palatine this summer. And FPA Multifamily this spring sold a 662-unit Rolling Meadows apartment building for $111 million, or 54 percent more than it bought the property for in 2017.

Goldman earlier this year sold the ground-floor retail portion of a Gold Coast building for $21 million, a deal that recouped nearly all of the firm’s $23 million purchase in 2015 of the whole property, which includes eight stories and 82,000 square feet of office space above the retail.

Read more